Received our Postcard?

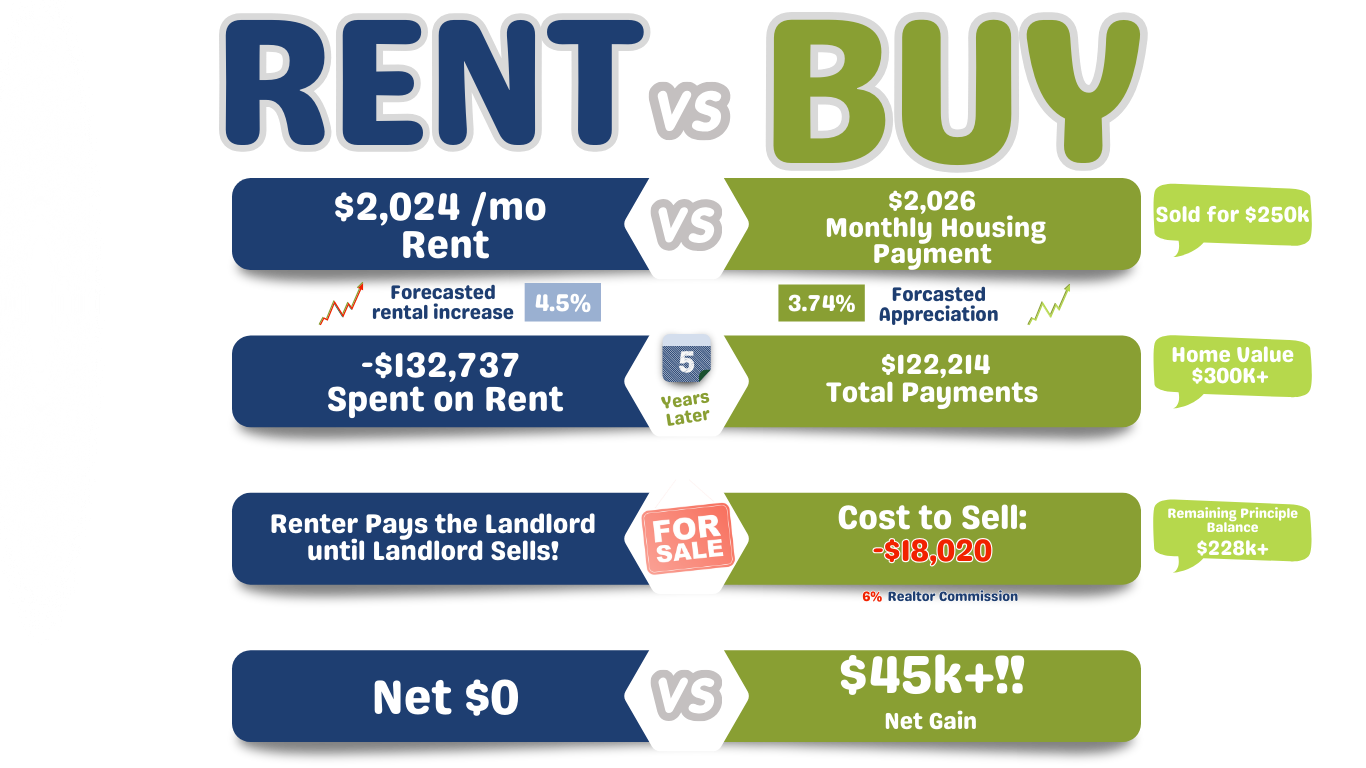

Deciding whether to rent or buy has a big impact on your finances and how you live your life. Renting gives you the freedom to move around, while buying gives you stability and the chance to build equity over time. Our website is here to help you grasp these distinctions fully so you can make choices that fit your individual situation. Whether you’re new to the home-buying scene or have been renting for years, we’re here to offer expert guidance and resources to help you navigate the path to owning your own home with confidence.

Read on to learn more!

*Mortgage Figures and rates are for informational purposes only based on: $250k purchase price, financed UFMIP $4221, FHA Total Loan Amount $245,471, 30/yr fixed rate of 6.125%/6.914%APR, P&I Payment $1491.51/mo, total payment of $2,026 includes taxes, insurance, PMI. $15,750 includes estimated closing costs of $7,000 plus a 3.5% downpayment. *Remaining Principal Balance figures based on: value after 5 years totaling $228,771. * Future Value after 5 years is based on a 3.4% Forecasted appreciation increase (avg.yr.) *Cost to sell based on 6% real estate commission of $18,020. APR = Annual Percentage Rate. P & I refers to Principal and Interest. Final loan approval is subject to credit and underwriting guidelines. Based on a credit score of 700. Single Family Residence in Pensacola area. Actual payment may vary based on the home’s escrow figures and the borrower’s qualifications. If eligible/available, upfront mortgage costs could be reduced with seller concessions or first-time homebuyer programs. Guidelines are subject to change. For current rates, please contact MLO or visit our website. This is not an offer of credit, not all applicants will qualify. See website for more details including licensing information: www.TridentHomeLoans.com. Equal Housing Lender THL Corporate office: 6723 Plantation Rd, Pensacola, FL 32504. NMLS 65716.

Ready to Learn More?

Ashley and Elaine are dedicated to helping you understand some of the main points of how to transition from renting to buying. In the following videos, we will discuss what we look at when qualifying for a mortgage, assess your financial readiness, weigh the pros and cons of renting vs buying, and master the art of negotiating contracts.

Ashley and Elaine are dedicated to helping you understand some of the main points of how to transition from renting to buying. In the following videos, we will discuss what we look at when qualifying for a mortgage, assess your financial readiness, weigh the pros and cons of renting vs buying, and master the art of negotiating contracts.

Qualifying for a Mortgage

Starting with a lender is vital in the home buying process and should be the first step towards your homebuying journey. A loan originator assesses your finances, guides you through pre-approval, and helps you set a realistic budget.

In this video, we explain the details behind qualifying for a mortgage.

Financial Readiness

What is the cost difference in renting versus buying? In this video, Elaine from aDoor Real Estate breaks down the crucial factors of financial readiness for renting versus buying.

In this video, we explain the implications of rent vs buy costs.

Renting vs. Buying

The monthly expenses associated with renting versus buying differ greatly.

In this video, we explain the different expenses that renters versus homeowners are responsible for.

Negotiating the Contract

Ready to make an offer on a home?

In this video, we highlight the vital collaboration between a mortgage loan originator and realtor for a successful home buying offer.

Loan Products

By understanding your financial situation, goals, and preferences, a mortgage loan originator can guide you through the process of selecting the best loan product that aligns with your budget constraints and long-term financial objectives.

Conventional Loan

The conventional loan is a versatile and widely chosen option for property purchases and refinances, covering primary residences, second homes, and investment properties. Conventional loans cater to various needs, from first-time homebuyers to investors.

Conventional Loan Features:

- Flexible terms and fixed rates

- Down payment as low as 5%, though 3% down payment options are available

- Suitable for credit scores above 620 with a 20% down payment

- Up to 50% DTI, with compensating factors

- Maximum loan amount of $647,200 for single-family residences (Higher limits may apply; consult our experts for local area information.)

FHA Loans

If your credit is less than ideal and/or you have a low down payment amount available, consider a loan through the Federal Housing Assurance program.

The Federal Housing Assurance program is a government-backed program that allows borrowers to finance a home that they normally may not be able to qualify for through conventional means. This type of loan is a mortgage insured by the Federal Housing Administration (FHA).

While this is a popular choice for first time homebuyers, it’s not limited to them. This is a great option for those with less than 20% down or those who have lower credit scores due to financial hardship or bankruptcy, etc. (Bankruptcy requires a seasoning period, so check with your Loan Officer on those details.)

USDA Loans

Did you know that most of the country actually falls under the option of a United States Department of Agriculture (USDA) loan? These are usually more rural areas. This doesn’t mean you can’t be near the city, it just means you may be outside city limits. Check the qualification map to see if your desired property qualifies. (This does not include investment properties.)

This program does not require a down payment but it does require a minimum credit score (620 average) and has income limits. Any and all members of the household can not exceed the income limit. This limit is determined by the location, so check here for more information. The applicant must not exceed 115% the median income in that county – this includes all eligible individuals able to work in the household, regardless if they are on the loan. This includes bonus’, commissions, etc.

USDA Loan Features:

- Must meet income and credit standards

- Little-to-no down payment

- Must be USDA Eligible (up to 97% of United States land is eligible)

- Eligible applicants may build, rehabilitate, improve, or relocate a dwelling in an eligible rural area.

Note that the USDA loan program provides a 90% loan note guarantee to approved lenders in order to reduce the risk of extending 100% loans to eligible rural home-buyers.

VA Home Loans

Our most popular loan product is the VA loan.

If you have served in the Military for more than 90 days you may be eligible for a VA loan. In fact, there are many ways you can qualify, if you were involved with the Military. Veterans, active military personnel, and military spouses who qualify can apply today. The benefits of this loan program is that it is backed by the Government and requires no down payment and no MIP (Mortgage Insurance Premium). The VA loan program does require a funding fee depending on number of uses but if you receive disability benefits – this can be reduced or removed.

To use this loan, you, or your immediate family, must occupy or intend to occupy the residence within a reasonable period. If you use this loan type for a new construction, the builder must be VA approved (Trident Home Loans can help with that) and they must provide a warranty for the build – this is an added benefit to you!

- VA: No down payment required

- No Mortgage Insurance VA Benefits Eligibility required

- 41% DTI or lower Higher LTV available with Collateral Lender-paid Funding Fee options available

- Lender credit options available Jumbo & Condo financing available $144K Min. loan

- VA LOANS* (U.S. Department of Veterans Affairs) One must have a suitable credit score, sufficient income, and a valid Certificate of Eligibility in order to be eligible for a VA-guaranteed loan program. Also, the home that is being purchased must be intended for residential use only.

- VA home loans can be used to:

- •Buy a residential home or condominium unit.

- •Build, repair, alter or improve a home. •Simultaneously purchase and improve a home.

- •Refinance an existing home loan (to reduce the current interest rate or to go from any loan program to a VA loan)

- •Improve a home by installing energy-related features or making energy-efficient improvements. *As per VA.GOV

Refinancing Options

Explore refinancing for various reasons, including the VA IRRRL, Cash-out, and Rate Term options.

- Cash-Out Refinance:

- Tap into home equity for repairs or debt repayment.

- VA loans allow up to 100% equity, while conventional loans permit about 85%.

- Rate Term Refinance:

- Optimal when rates are favorable or to alter the loan program.

- Consider refinancing after two years for potential substantial savings.

- VA IRRRL (Interest Rate Reduction Refinancing Loan):

- Ideal for lowering rates on existing VA loans.

- Simple qualifications and minimal documentation.

- Seasoning period requirement of 210 days from the first payment.

Contact our expert loan officers to explore refinancing opportunities and get started.

Creating a budget

Curious about your future mortgage payments? Jumpstart your budgeting journey and gauge your home-buying capacity with our mortgage calculator.

Our Team of experts are here to guide you on your homebuying journey. Contact us today!

Ashley Barber

Mortgage Loan Originator | NMLS# 1013732

[email protected] | 850-343-0208

6723 Plantation Road, Pensacola FL 32504

Elaine Hayward

Realtor (aDoor Real Estate) | License SL3590067

[email protected] | 404-441-5871

401 E Chase St #100, Pensacola, FL 32502

*Disclaimer: Trident Home Loans, LLC. NMLS 65716. P&I refers to Principal and Interest. The monthly payment does not include information regarding taxes, insurance, HOA and other fees, which may result in higher monthly payments. Final loan approval is subject to credit and underwriting guidelines. Guidelines are subject to change. Not all borrowers will qualify. Any offers or advertisements for mortgage products on our website or other platforms are subject to conditional approval. The actual terms and conditions of a mortgage loan, including interest rates, loan amounts, and eligibility, are dependent upon several factors, including the borrower’s creditworthiness. Trident Home Loans reserves the right to modify or revoke any offer, and final approval is contingent upon the completion of a full application, verification of information provided, and meeting all underwriting requirements. Please note that this disclaimer is provided for informational purposes and may be subject to updates or changes in accordance with regulatory requirements. Borrowers are encouraged to contact Trident Home Loans directly for the most up-to-date and accurate information regarding mortgage products and offerings. This advertisement is not an offer to lend, and all applications are subject to credit approval. Terms and conditions ma apply.