5 Tips for first - time homebuyers in 2024

1.Evaluate Your Finances: Before diving into the homebuying process, assess your financial situation. Understand your budget, credit score, and how much you can afford to spend on a home. Consider additional costs like property taxes, maintenance, and insurance to ensure a comprehensive financial picture.

2.Research the Market: Stay informed about the current real estate market trends in your desired location. Look for neighborhoods that align with your preferences and budget. Understanding market conditions will empower you to make informed decisions and negotiate effectively.

Source: Trident Home Loans

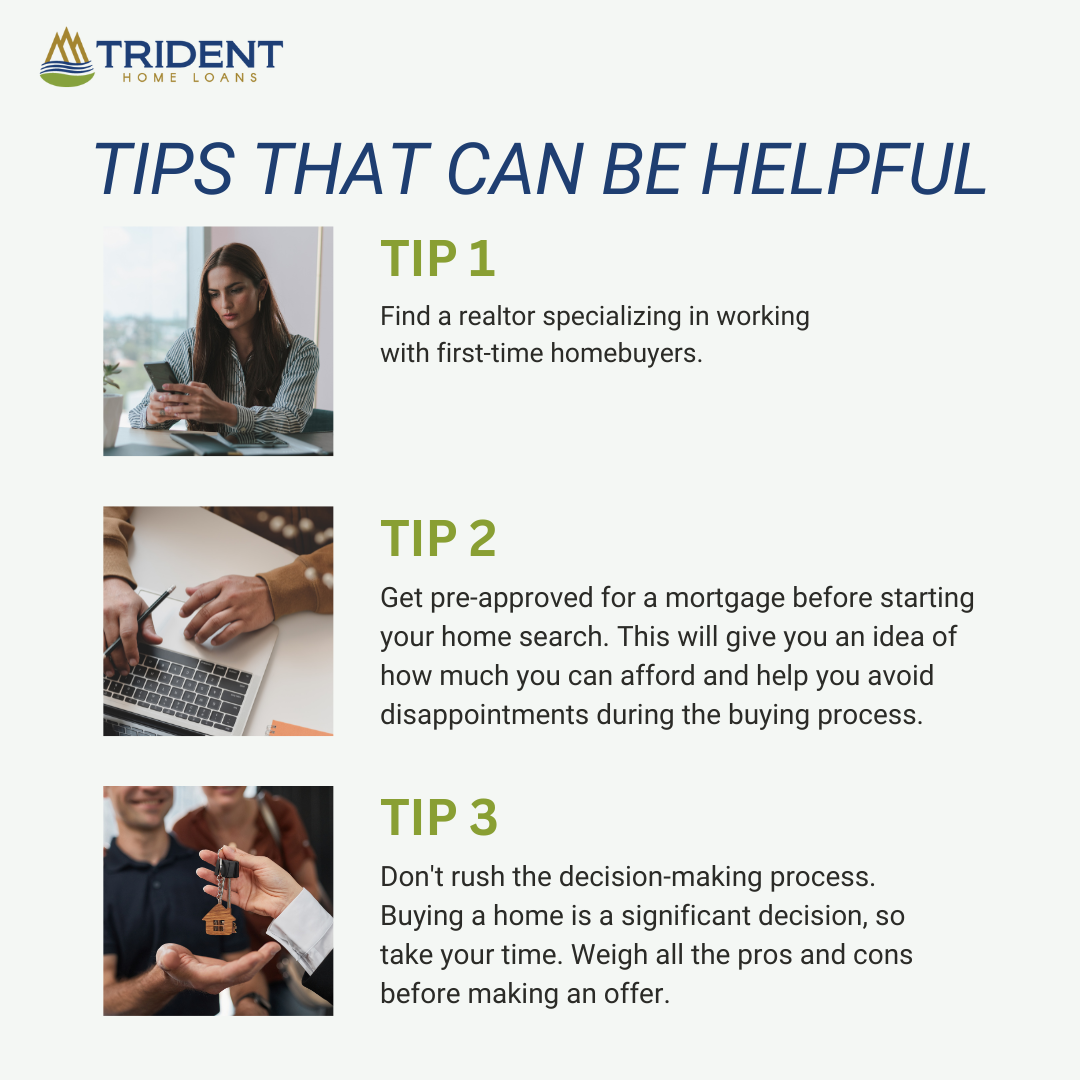

3.Get Pre-approved for a Mortgage: To strengthen your position as a buyer, get pre-approved for a mortgage. This not only helps you determine your budget but also signals to sellers that you are a serious buyer. It can expedite the buying process and give you a competitive edge in a competitive market.

4.Consider Future Resale Value: While choosing a home, think about its potential resale value. Even if you plan to stay in the home for a long time, life circumstances can change. Opt for a property with features and amenities that appeal to a broad range of potential buyers to ensure a higher resale value.

5.Work with a Trusted Real Estate Professional: The homebuying process can be complex, especially for first-time buyers. Enlist the services of a reputable real estate agent who can guide you through the process, provide valuable insights, and help you navigate any challenges that may arise. Their expertise can make the journey smoother and more enjoyable.