Second Mortgage Rates: Everything You Need to Know

Second mortgages can be an excellent financial tool for homeowners looking to tap into the equity of their property. Whether for a home renovation, debt consolidation, or covering unexpected expenses, understanding second mortgage rates is essential for making the right decision. This guide provides an in-depth look at second mortgage rates, what affects them, and how you can secure the best deal.

What Are Second Mortgage Rates?

Second mortgage rates refer to the interest rates applied to loans secured against the equity of your property, beyond your primary mortgage. Since they are considered secondary to your first mortgage in terms of repayment priority, these loans often come with slightly higher rates.

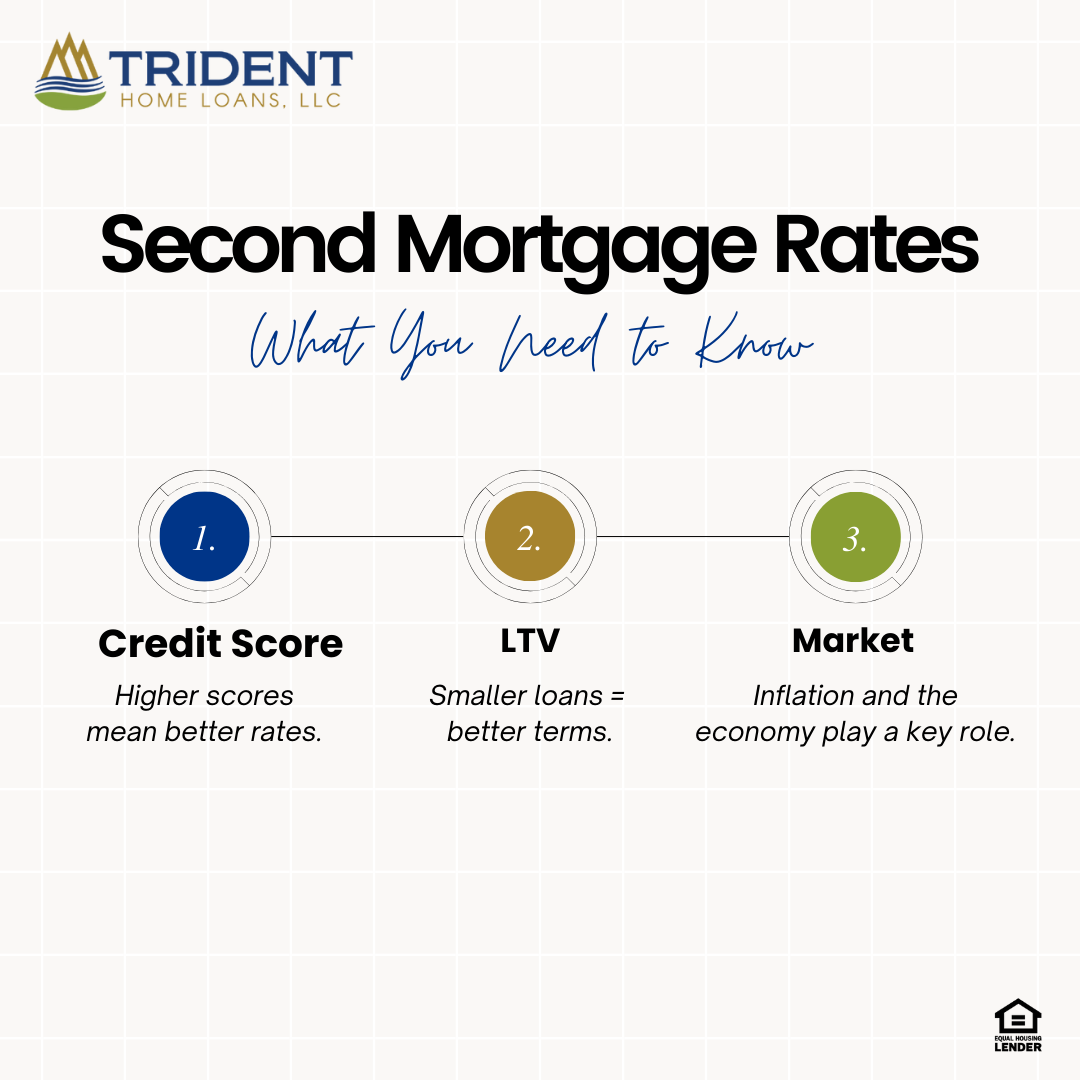

Factors influencing second mortgage rates include:

- Credit Score: Borrowers with higher credit scores typically qualify for lower interest rates.

- Loan-to-Value Ratio (LTV): The amount borrowed compared to the home’s equity impacts rates.

- Market Trends: Economic factors such as inflation, Federal Reserve policies, and market demand influence overall mortgage rates.

Second Home Mortgage Rates Explained

Second home mortgage rates apply to loans taken to purchase a property that is not your primary residence. These can be vacation homes, investment properties, or additional residences.

How Are Second Home Mortgage Rates Determined?

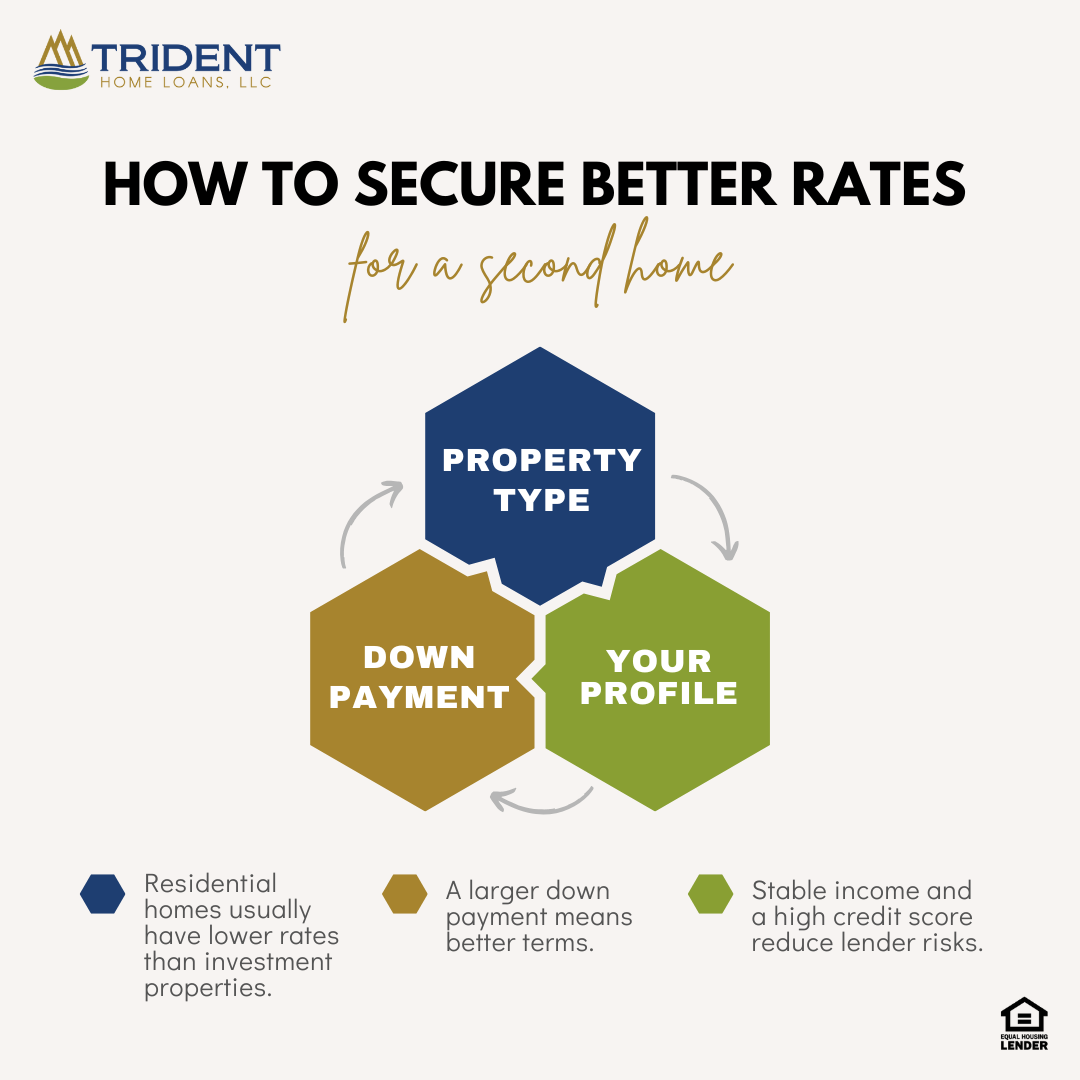

Several factors influence these rates, including:

- Risk Assessment: Lenders often view second homes as higher risk since they are not primary residences.

- Down Payment: A higher down payment can lower your interest rate.

- Loan Term: Shorter terms often result in lower rates compared to long-term loans.

Exploring 30-Year Second Home Mortgage Rates

A 30-year loan for a second home can offer stability with fixed monthly payments. While the interest rates for these loans are often slightly higher than primary residence loans, they still provide affordability through long repayment terms.

Benefits of a 30-Year Second Home Mortgage

- Lower Monthly Payments: Spreading the loan over 30 years reduces the financial burden.

- Predictability: Fixed rates ensure consistent payments, aiding financial planning.

Considerations for Borrowers

While a 30-year term offers flexibility, the long duration results in higher total interest payments. Borrowers should weigh these costs against their long-term financial goals.

Understanding Second Mortgage Interest Rates

Second mortgage interest rates are typically higher than those for primary mortgages due to their subordinate repayment priority. However, with proper planning, you can still secure competitive rates.

Factors That Affect Second Mortgage Interest Rates

- Economic Conditions: Rates tend to rise during periods of inflation and economic growth.

- Loan Type: Fixed-rate loans usually have higher rates than variable-rate loans initially but offer stability over time.

- Borrower Profile: Your income, creditworthiness, and employment stability significantly affect rates.

Recent Trends: US Mortgage Rates Drop for Second Week in a Row

In recent weeks, U.S. mortgage rates have dropped for the second week in a row, offering opportunities for homeowners to lock in favorable terms. Lower rates can benefit those looking to refinance their primary or second mortgage or purchase a second home.

What Does This Mean for Borrowers?

For those considering a second mortgage, this decline presents an opportunity to secure a loan at a lower cost. Additionally, it could signal a broader trend in the market, making this an ideal time to assess your financial options.

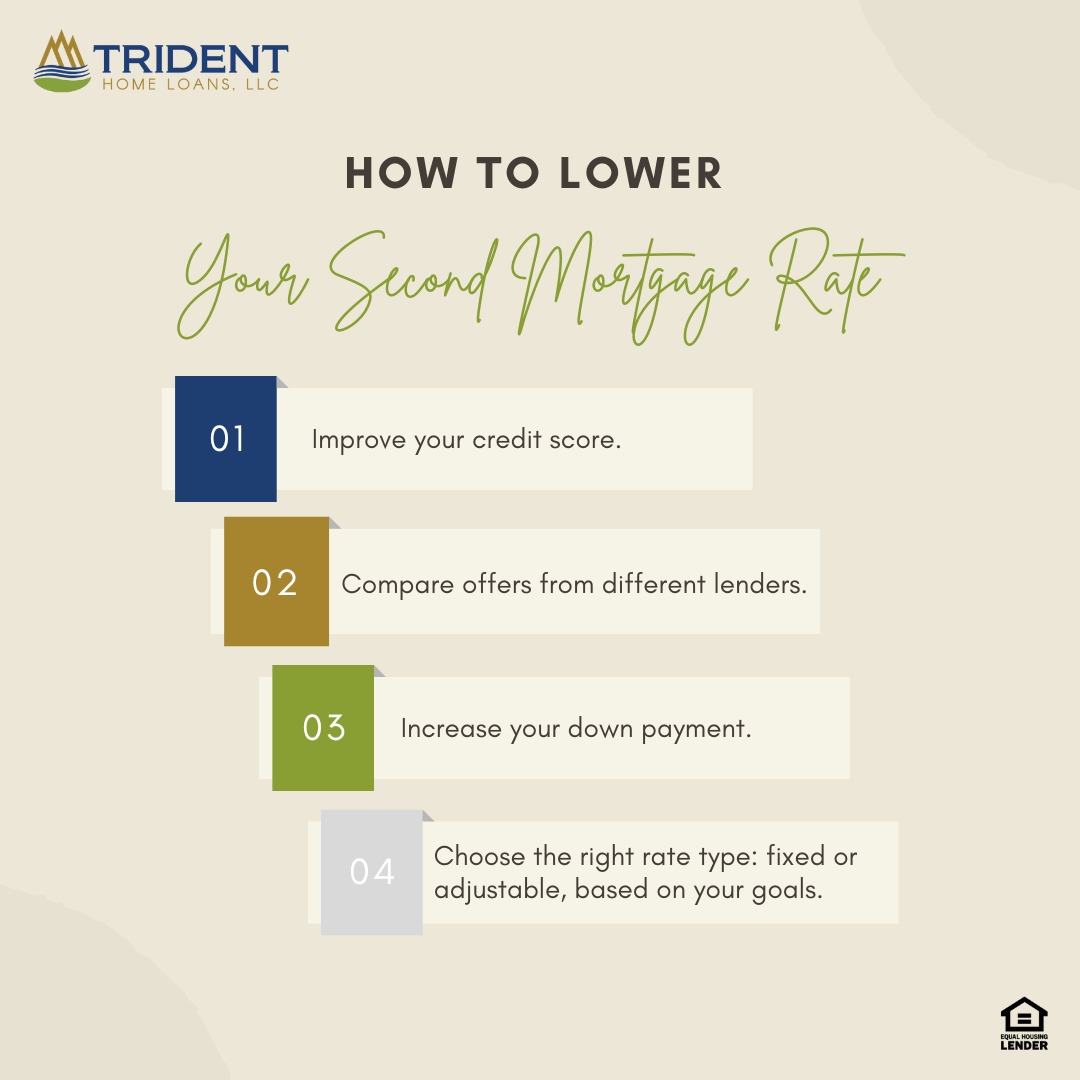

Tips to Secure the Best Second Mortgage Rates

- Improve Your Credit Score: Higher scores demonstrate financial reliability to lenders.

- Shop Around: Comparing offers from multiple lenders ensures you get the best deal.

- Consider a Larger Down Payment: Reducing the loan amount can lower interest rates.

- Choose the Right Loan Type: Determine whether a fixed or adjustable rate is better suited to your needs.

Conclusion

Second mortgages provide a versatile financial solution for homeowners looking to utilize their home equity. Understanding the nuances of second mortgage rates, including those for second homes and 30-year terms, can help you make informed decisions. Additionally, with U.S. mortgage rates dropping for the second week in a row, now may be the perfect time to explore your options.

By improving your credit score, shopping around, and carefully analyzing your needs, you can secure favorable terms that align with your financial goals.

FAQs

1. What is a second mortgage?

A second mortgage is a loan secured against your property, secondary to your primary mortgage.

2. How can I qualify for the best second home mortgage rates?

Improve your credit score, increase your down payment, and compare multiple lenders to find the best rate.

3. Are 30-year second home mortgages a good option?

Yes, they provide stability and affordability, but consider the higher total interest over the loan’s duration.

4. Why are second mortgage rates higher than primary mortgage rates?

Second mortgages carry higher risk for lenders since they are secondary in repayment priority.

5. How can I benefit from declining U.S. mortgage rates?

Lower rates provide opportunities to refinance or secure better terms for new loans.

Source: Trident Home Loans