Construction Loan Rates: Trends & Forecasts for 2025

Introduction

Building a home requires careful financial planning, and one of the most crucial aspects is understanding construction loan rates. Unlike traditional mortgages, construction loan interest rates fluctuate based on market conditions, lender policies, and borrower qualifications. Staying informed about construction loan interest rates in 2025 can help borrowers secure the best possible terms [source: industry mortgage trends].

What Are Construction Loan Interest Rates?

A construction loan interest rate is the cost of borrowing money for home construction. These loans differ from standard mortgages as they provide short-term financing and typically convert into permanent loans after construction completion [source: Federal Reserve mortgage reports].

Key Features of Construction Loan Interest Rates:

- Higher than traditional mortgage rates – Due to increased lender risk.

- Short-term financing – Loans generally last 6 to 18 months.

- Interest-only payments – Borrowers usually pay only interest during the construction phase.

- Adjustable or fixed rates – Some lenders offer fixed rates, while others use market-based adjustable rates.

Factors Affecting Construction Loan Interest Rates

Several elements influence construction loan rates, including:

- Credit Score – Higher scores qualify for lower interest rates.

- Down Payment – A larger down payment reduces lender risk and improves rate offers.

- Loan-to-Value Ratio (LTV) – A lower LTV ratio often results in better terms.

- Economic Conditions – Federal Reserve policies, inflation, and lender demand affect rates [source: mortgage industry data].

Construction Loan Interest Rates in 2024: A Look Back

Last year, construction loan interest rates in 2024 were influenced by inflation trends and Federal Reserve policies. Many borrowers saw moderate fluctuations in rates due to shifting market conditions [source: Federal Reserve outlook].

Key Observations from 2024

- Slight Decrease in Rates – As inflation slowed, some lenders adjusted their construction loan rates downward.

- Tighter Lending Criteria – Lenders placed a stronger emphasis on creditworthiness and financial stability.

- Competitive Market – Borrowers who shopped around found more favorable loan terms.

Average Construction Loan Interest Rates in 2024

- Fixed-Rate Construction Loans: 7.5% – 9.0%

- Adjustable-Rate Construction Loans: 6.5% – 8.5%

- Government-Backed Loans (FHA & VA): 6.0% – 7.5%

Construction Loan Interest Rates in 2025

Looking ahead, construction loan interest rates in 2025 will depend on market conditions and regulatory policies [source: mortgage market forecast].

What to Expect for Construction Loan Interest Rates in 2025

- Potential Rate Stabilization – If economic recovery remains steady, rates may level off.

- Lender Flexibility – More customized loan options may emerge.

- Federal Reserve Policy Impact – Interest rates may remain within the projected range of 7% to 9%.

Estimated Construction Loan Rates for 2025

- Fixed-Rate Construction Loans: 7.0% – 8.5%

- Adjustable-Rate Construction Loans: 6.0% – 8.0%

- Government-Backed Loans (FHA & VA): 5.5% – 7.0%

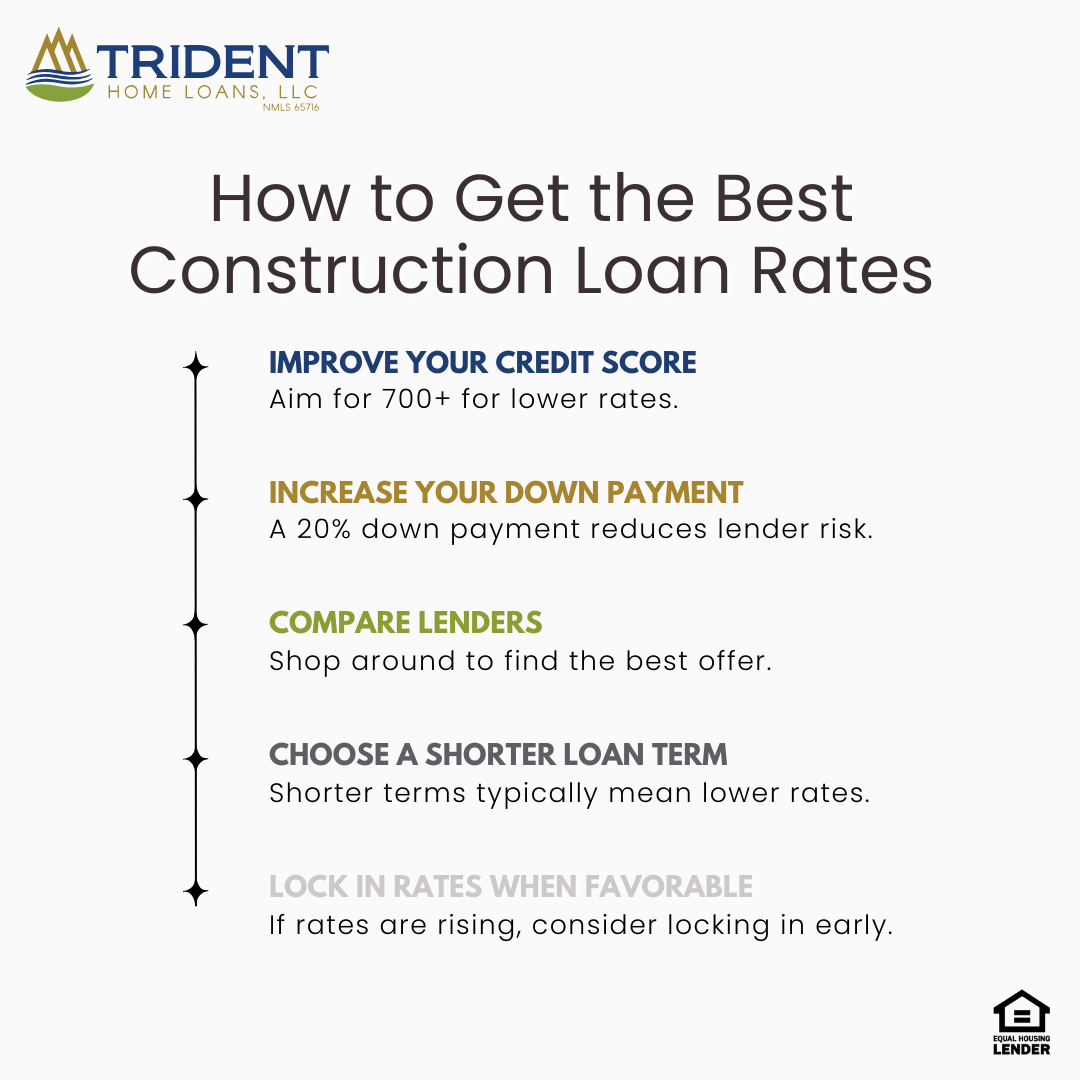

How to Get the Best Construction Loan Rates

To secure the most competitive construction loan rates, consider these strategies:

- Improve Your Credit Score – A 700+ credit score qualifies for lower rates.

- Increase Your Down Payment – A 20% down payment reduces lender risk.

- Compare Lenders – Shop around for different offers [source: consumer finance reports].

- Choose a Shorter Loan Term – Shorter terms typically have lower rates.

- Lock in Rates When Favorable – If rates are rising, consider locking in early.

Conclusion

Understanding construction loan interest rates is essential for managing the cost of building a home. As construction loan rates continue evolving in 2025, staying informed will help borrowers make smart financial decisions.

By comparing construction loan interest rates, improving financial standing, and working with the right lender, borrowers can secure the best possible financing for their home construction projects [source: home loan industry insights].

Source: Trident Home Loans