Construction Loan Rates

In 2025, the housing and construction markets continue to evolve, making it more important than ever to understand how construction loans work and what you can expect in terms of cost. From interest rates to program types, this comprehensive guide breaks down everything you need to know about construction loan rates, helping you make informed decisions whether you’re building a custom home or investing in a commercial project

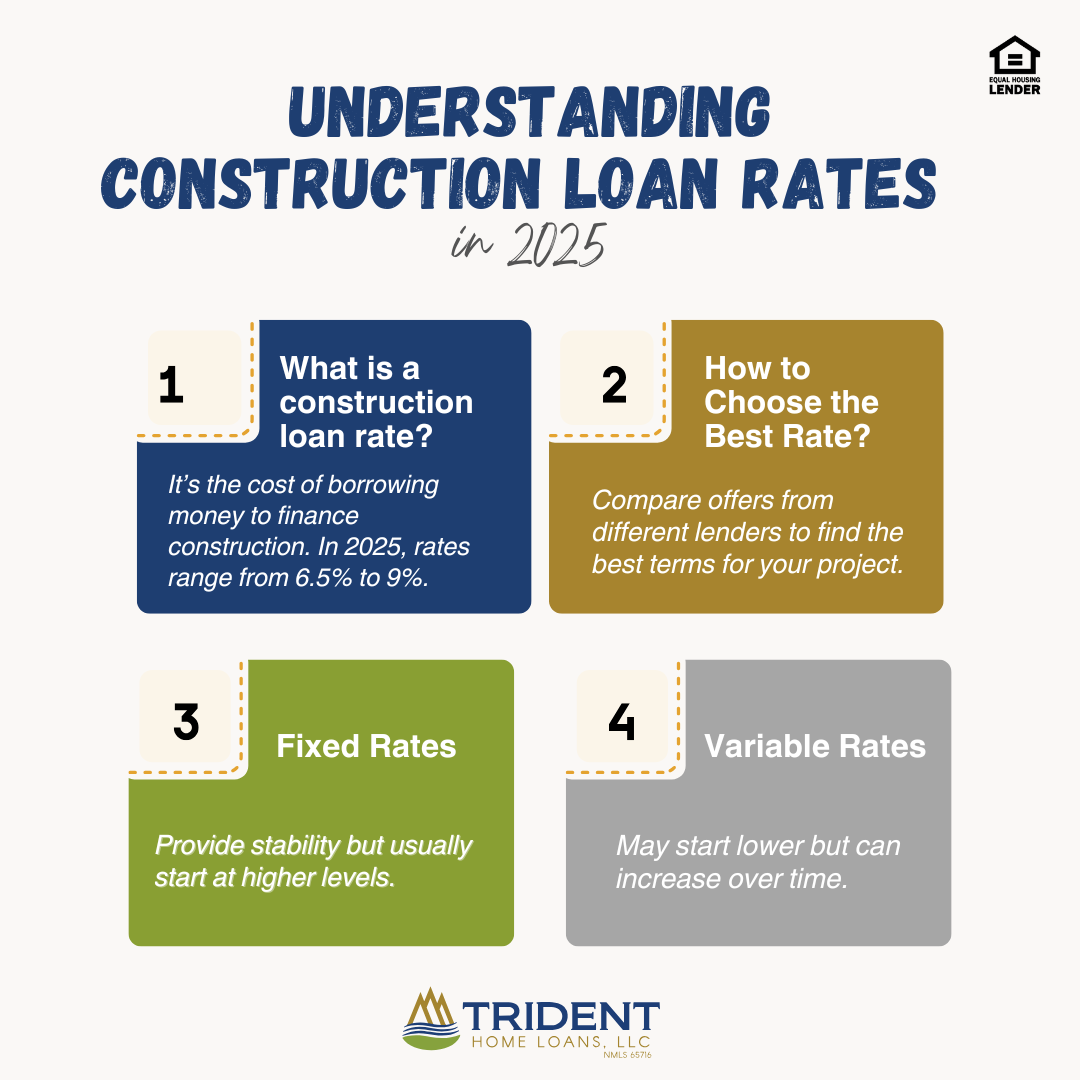

Understanding Construction Loan Interest Rates

Construction loan interest rates refer to the cost of borrowing money to finance the construction of a new property. These loans are typically short-term and may feature interest-only payments during the construction period. As of 2025, construction loan interest rates today remain elevated due to inflationary concerns and economic policies set by the Federal Reserve.

Most current construction loan interest rates range between 6.5% and 9%, depending on borrower creditworthiness, location, loan amount, and lender. These rates are usually higher than those of traditional mortgages due to the increased risk and short-term nature of the loan.

Fixed vs. Variable Construction Loan Rates

Borrowers can typically choose between fixed or variable construction loan rates. Fixed rates provide stability and predictability but often start higher. Variable rates may start lower but can increase over time. In 2025, those seeking the best construction loan rates often compare multiple offers and choose hybrid or adjustable structures to save in the early stages.

What Do Construction Loan Rates Look Like Today?

Understanding construction loan rates today means recognizing that they are subject to rapid fluctuations. Most financial institutions report the following averages:

- Fixed-rate construction loans: 7.0% – 8.5%

- Adjustable-rate construction loans: 6.5% – 7.9%

When compared to construction loan interest rates 2024, current conditions show signs of stabilization, though not a full return to pre-pandemic lows. Monitoring rate trends and acting quickly when favorable terms appear is essential.

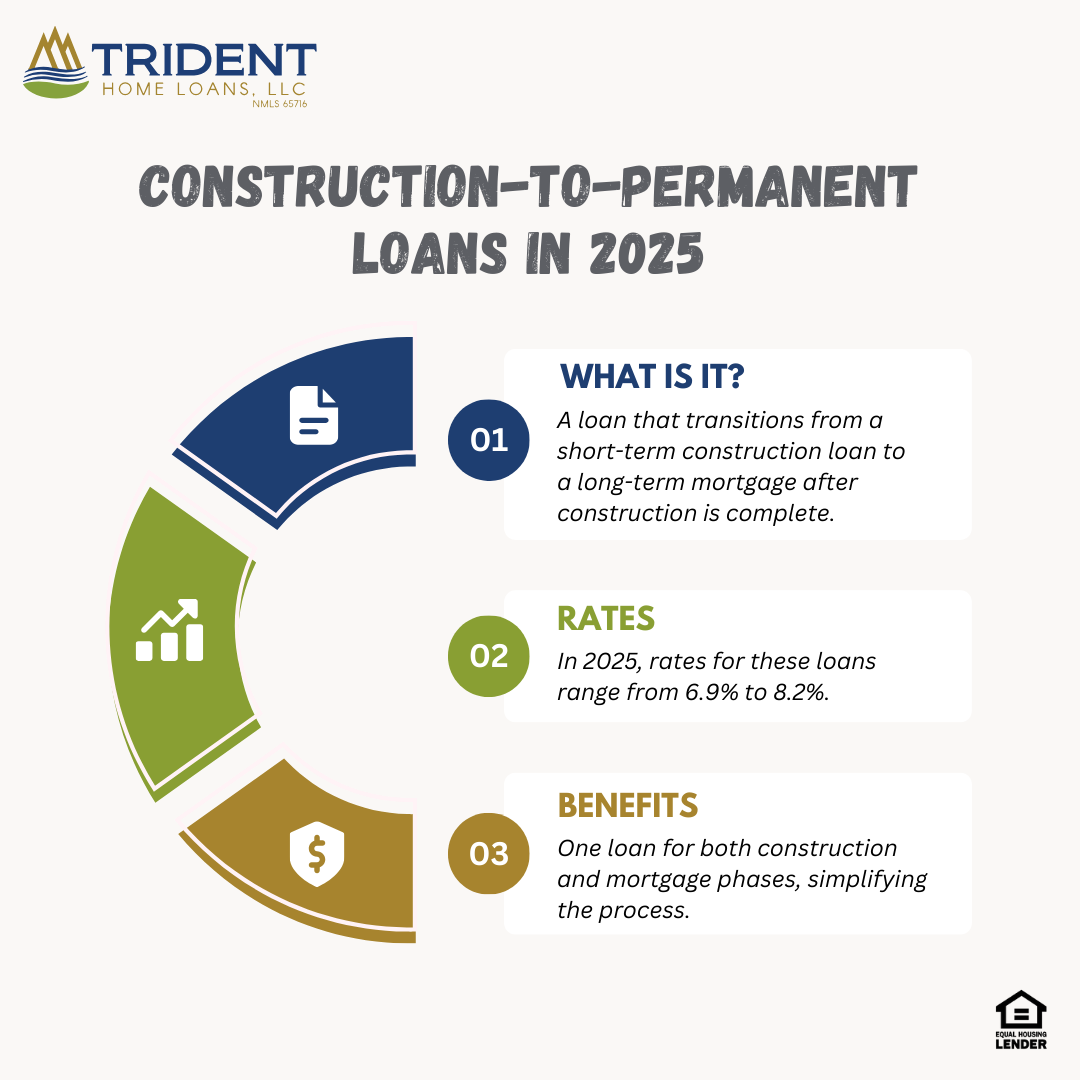

Construction-to-Permanent Loan Options

One of the most popular structures is the construction-to-permanent loan, which transitions from a short-term construction phase to a long-term mortgage after completion. For those considering a 30-year plan, 30 year construction-to-permanent loan rates generally fall in the 6.9% to 8.2% range in early 2025.

Lenders offering construction-to-permanent loan rates today often bundle closing costs and provide rate-lock options. This loan type is ideal for borrowers who want simplicity and a single approval process.

Government-Backed Construction Loans

For qualifying borrowers, government programs like VA and FHA construction loans can be an attractive solution.

- VA construction loan rates typically range from 6.0% to 7.25%, offering favorable terms for veterans and active military personnel.

- FHA construction loan rates are slightly higher but remain competitive, especially for first-time homebuyers or those with lower credit scores.

These programs often require specific property criteria and documentation but can lower barriers to entry for many Americans.

Residential vs. Commercial Construction Loan Rates

The distinction between residential construction loan rates and commercial construction loan rates lies primarily in the scope and risk of the project. Residential rates in 2025 average between 6.7% and 8.8%, while commercial projects, depending on size and complexity, may range from 7.5% to over 10%.

Lenders assess risk differently for commercial ventures, often requiring more documentation, larger down payments, and detailed project timelines.

Regional Focus: Construction Loan Rates in Georgia

For those building in the Southeastern U.S., construction loan rates Georgia remain aligned with national averages but may vary based on local competition and development demand. In metro areas like Atlanta, increased housing starts and demand for suburban development have led to slight rate upticks, with most loans falling between 6.9% and 8.4%.

New Construction Home Loan Rates

New construction loan rates for homes remain strong as demand for custom builds continues. In 2025, new home construction loan rates and new construction home loan rates typically range from 6.5% to 8.0%, with slight differences depending on location and builder partnerships.

Some lenders offer discounts or package deals when partnering with preferred builders, which can be worth exploring.

Using a Construction Loan Rates Calculator

Many borrowers turn to a construction loan rates calculator to estimate their monthly payments, interest obligations, and potential long-term costs. These tools are essential in comparing offers from multiple lenders and modeling different scenarios for fixed vs. variable structures.

Online calculators allow inputs for principal, term length, estimated rate, and down payment, providing a clearer picture before beginning the loan application process.

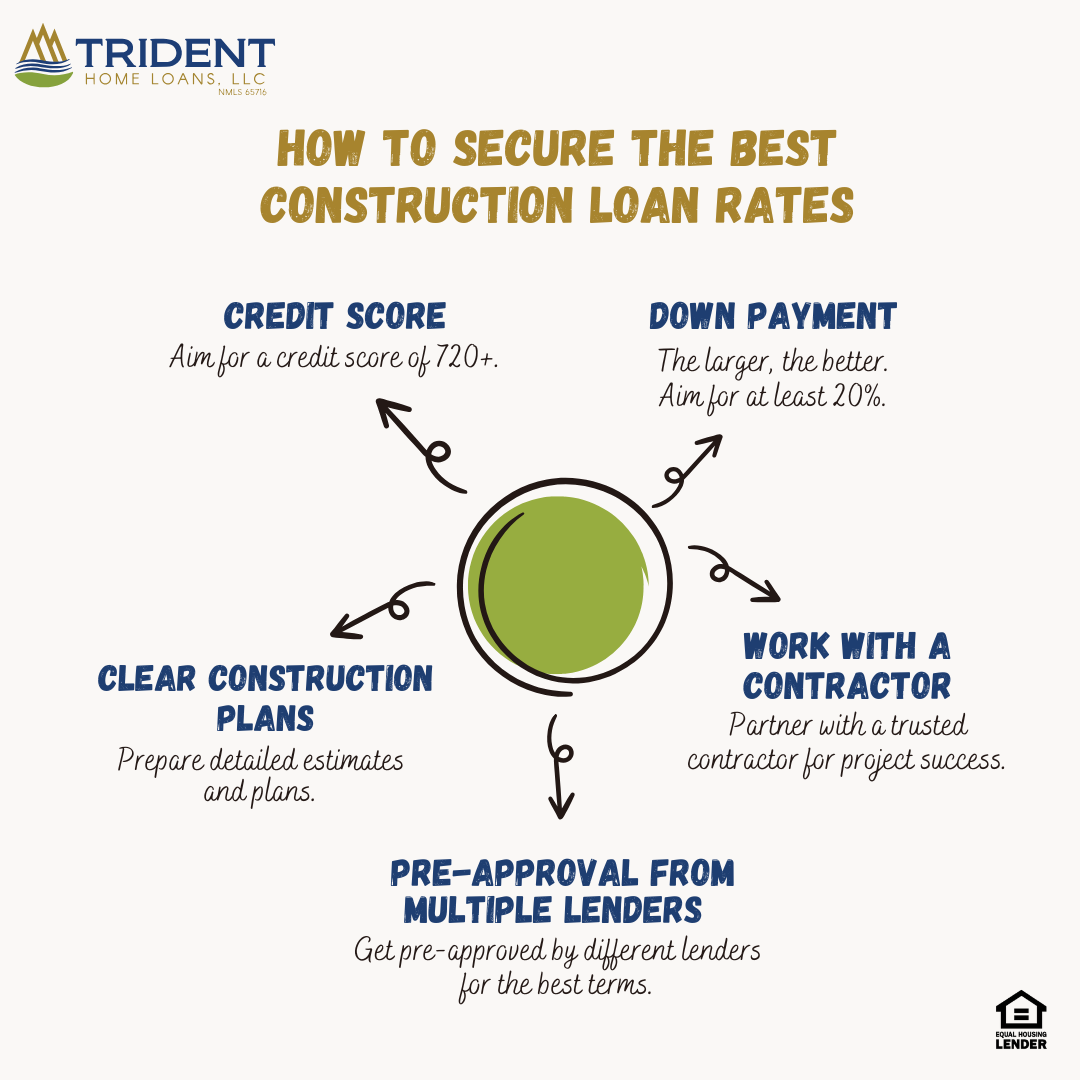

How to Qualify for the Best Construction Loan Rates

To secure the best construction loan rates, consider the following factors:

- A high credit score (typically 720+)

- A down payment of 20% or more

- Detailed construction plans and cost estimates

- Working with a reputable contractor

- Strong debt-to-income ratio and income documentation

Getting pre-approved with multiple lenders and negotiating rate terms can also help you access more favorable terms.

Final Thoughts

Navigating construction loan interest rates today requires a blend of market knowledge, financial preparation, and lender comparison. While construction loan interest rates 2024 were volatile, the 2025 landscape is showing signs of moderation. Whether you’re seeking current construction loan rates, evaluating construction-to-permanent loan rates, or researching commercial construction loan rates, it’s critical to align your project goals with the right financing product.

By understanding the many loan types available—including residential, new construction, VA, FHA, and 30-year construction-to-permanent loans—you’ll be better equipped to make a smart, cost-effective choice in 2025.

Source: Trident Home Loans