Credit Union Mortgage Rates: Expert Interview with Ashley Barber

In this article, we spoke with Ashley Barber, Director of Operations and Mortgage Loan Originator at Trident Home Loans. She shared her professional insights on how the company’s approach to mortgage loans differs from that of credit unions like UW Credit Union, Navy Federal Credit Union, and Summit Credit Union, and highlighted the advantages of working with a broker.

Question: How does Trident Home Loans handle flexibility compared to credit unions?

Ashley Barber:

“At Trident Home Loans, we believe every borrower deserves a solution tailored to their unique needs. Unlike credit unions, we offer a wide range of loan products to ensure you find the perfect fit.

Credit unions, such as UW Credit Union or Navy Federal Credit Union, often have strict overlays in their underwriting guidelines. As a broker, we can place loans with various partners who can underwrite to the borrower’s specific needs. This gives us significantly more flexibility and allows us to offer a broader range of products.”

Question: How does your process compare in terms of efficiency?

Ashley Barber:

“Our streamlined process allows us to get you to closing faster than the limited resources of many credit unions can manage. Time is money, and we’re here to save you both.

When you work with us, you’ll have a dedicated team assigned to your file throughout the entire process. This eliminates the need to deal with call centers, which are often used by credit unions like Navy Federal Credit Union or Summit Credit Union.”

Question: What sets Trident Home Loans apart in terms of expertise?

Ashley Barber:

“With access to a broad network of lenders, Trident Home Loans delivers options and insights that credit unions simply can’t match. Whether you’re buying locally or across the country, we have the experience and resources to find you the best deal.

For example, credit unions like UW Credit Union Mortgage Rates or Navy Federal Credit Union Mortgage Rates tend to focus on specific markets and borrower groups. In contrast, we work with a wide range of investors to deliver the most competitive terms available.”

Question: How do you ensure accessibility in your mortgage offerings?

Ashley Barber:

“Membership restrictions shouldn’t stand in the way of homeownership. At Trident Home Loans, we’re here to help everyone, no matter their background or location.

Credit unions such as Summit Credit Union or Navy Federal might limit access to their services because of membership requirements. We work individually with every client, helping them overcome any barriers to achieving their dream of owning a home.”

Question: What makes your approach to customer service unique?

Ashley Barber:

“Our team is dedicated to advocating for you. Unlike credit unions, we’re not tied to one specific institution, so we can truly focus on finding the best loan for your situation.

For instance, instead of being restricted to the products of a single credit union, as is often the case with UW Credit Union, we provide access to a wide variety of options. This allows us to secure the most favorable deal for your unique circumstances.”

Question: How do you ensure a competitive edge?

Ashley Barber:

“Credit unions like Navy Federal Credit Union or Summit Credit Union may offer low rates, but Trident Home Loans goes further by ensuring you have access to multiple lenders competing for your business—giving you the best terms possible.

As a broker, we partner with multiple investors, which not only allows us to provide the best rates but also ensures an exceptional client experience.”

Conclusion

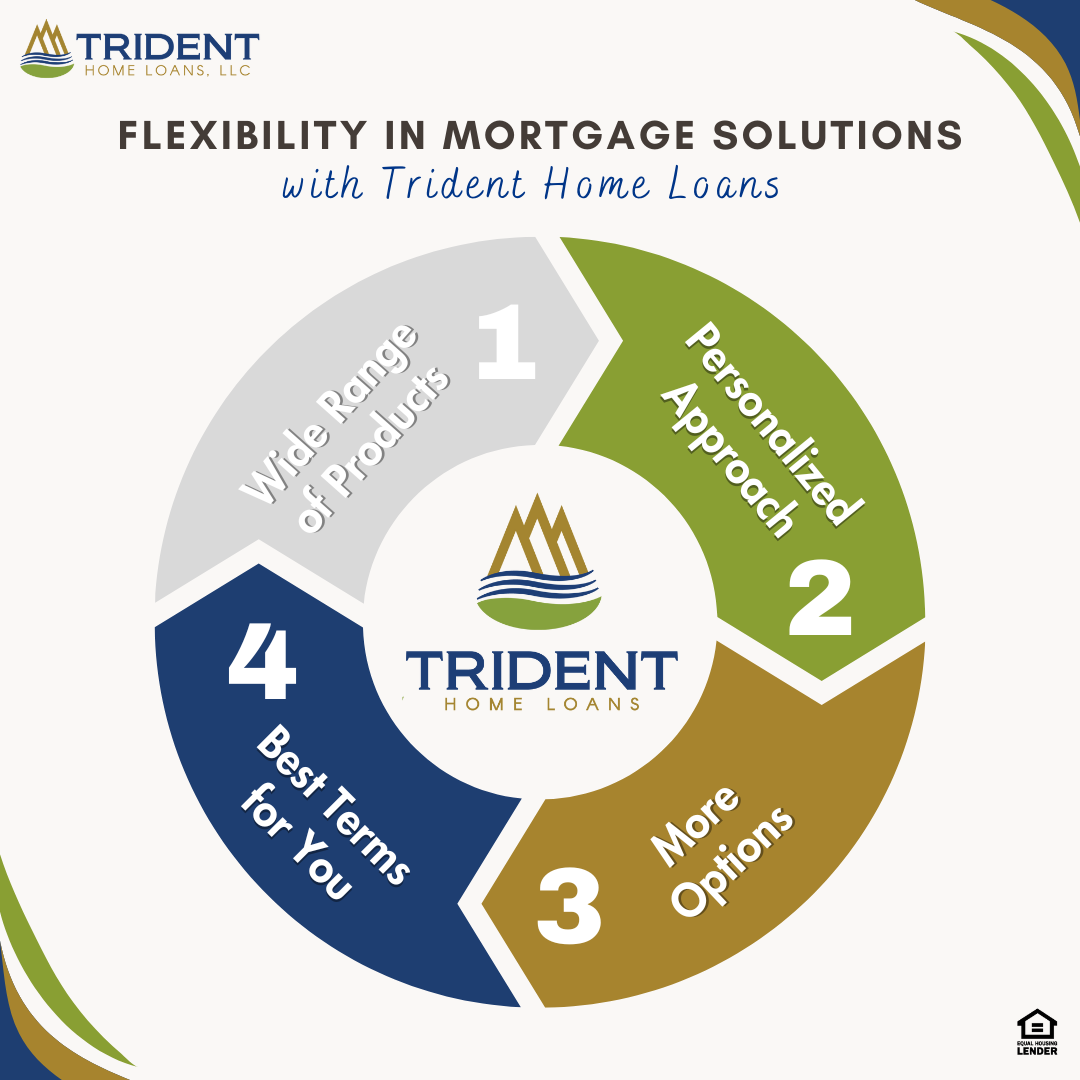

Working with a mortgage company like Trident Home Loans offers unique advantages that are hard to find with traditional credit unions. With flexibility, efficiency, expertise, and a personalized approach, clients gain access to a wide range of solutions tailored to their specific needs.

Source: Trident Home Loans