Discover Home Equity Loans

Home equity loans have become a popular financial tool for homeowners looking to leverage the value of their property. By borrowing against the equity in your home, you can fund significant expenses, consolidate debt, or invest in home improvements.

Discover Home Equity Loans stand out as a reliable option in the market. Offering competitive rates, transparent terms, and a straightforward application process, Discover has gained the trust of countless homeowners. Whether you are considering a lump-sum loan or exploring other financing options, Discover provides the flexibility and support you need.

Discover Home Equity Loans Reviews

Choosing the right lender is crucial, and reviews play a significant role in making that decision. Discover Home Equity Loans reviews frequently highlight several key advantages, such as:

- Streamlined Application Process: Many users praise the simplicity and speed of applying for a loan with Discover.

- Transparent Terms: Borrowers appreciate the clear communication about rates and repayment plans.

- Responsive Customer Service: The support team is often noted for their professionalism and helpfulness.

However, like any financial product, there are areas where Discover receives constructive feedback. Some users mention occasional delays in approval, while others seek more flexibility in loan amounts. Comparing Discover with other providers can help you understand where it excels and where it might fall short.

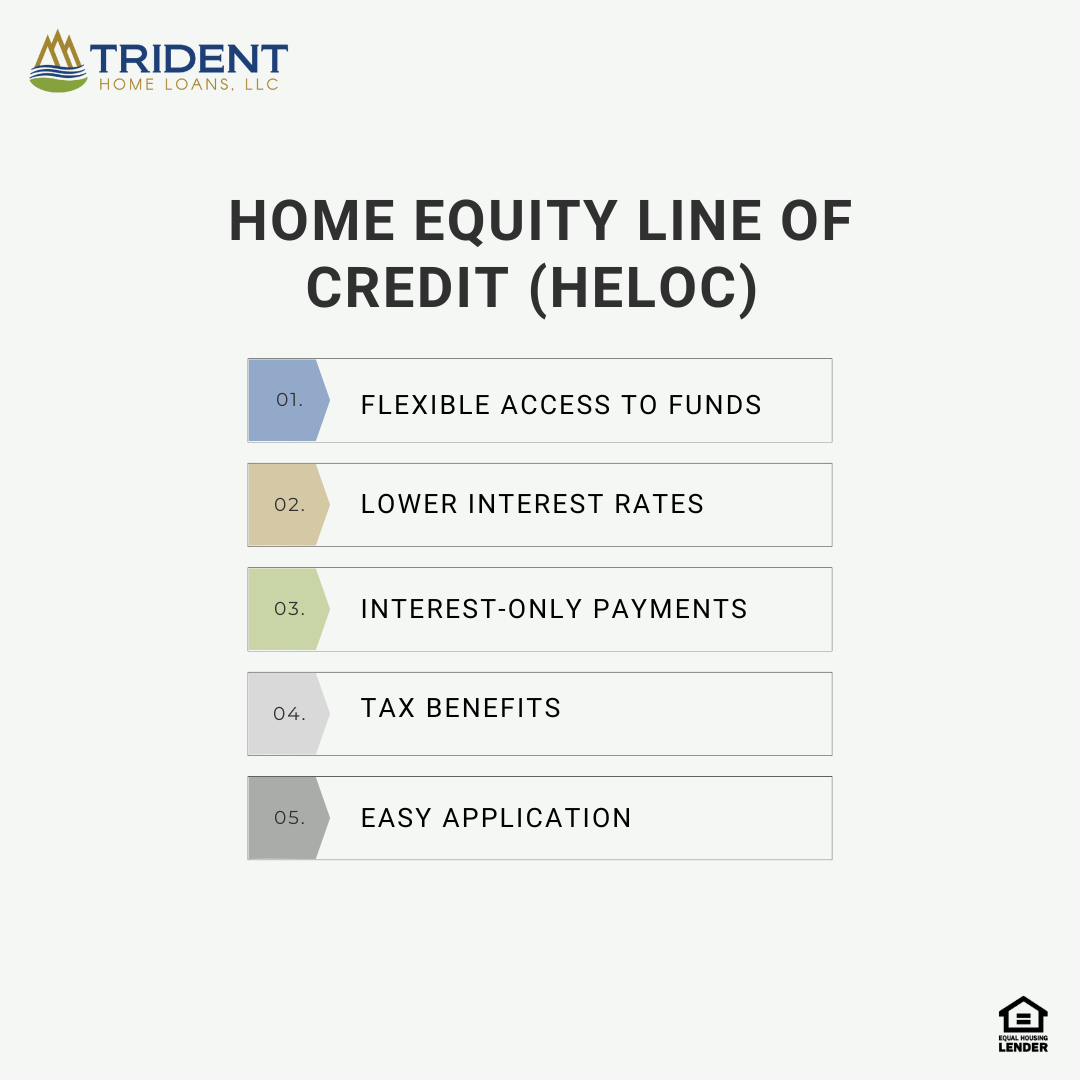

Home Equity Line of Credit

A Home Equity Line of Credit (HELOC) is another way to access your home’s value, offering flexibility compared to a traditional loan. Unlike a lump-sum payment, a HELOC allows you to withdraw funds as needed, making it ideal for ongoing expenses or projects.

Advantages of a HELOC include:

- Flexible Access to Funds: Borrow only what you need when you need it.

- Potentially Lower Interest Rates: Compared to credit cards or personal loans.

- Interest-Only Payment Options: During the draw period, you may have the option to pay only the interest.

While Discover focuses more on traditional home equity loans, exploring its offerings can provide insight into the most suitable option for your needs.

Home Equity Loan

A home equity loan is a straightforward way to secure funding, providing a lump sum at a fixed interest rate. These loans are particularly appealing for homeowners who prefer predictable monthly payments.

Key benefits of home equity loans include:

- Fixed interest rates for stability.

- A clear repayment schedule.

- The ability to finance significant projects, from renovations to education.

Discover’s home equity loans are tailored for homeowners seeking transparency and efficiency. With competitive rates and a user-friendly process, Discover ensures you can access the funds you need with confidence.

Source: Trident Home Loans