Home Loan Quote. Why it’s important to shop around.

Shopping around for a home loan can be a daunting task, but it is important to make sure you are getting the best rates and the right product for your needs. Finding the right lender can save you a lot of money in the long run, so it is worth taking the time to do your research.

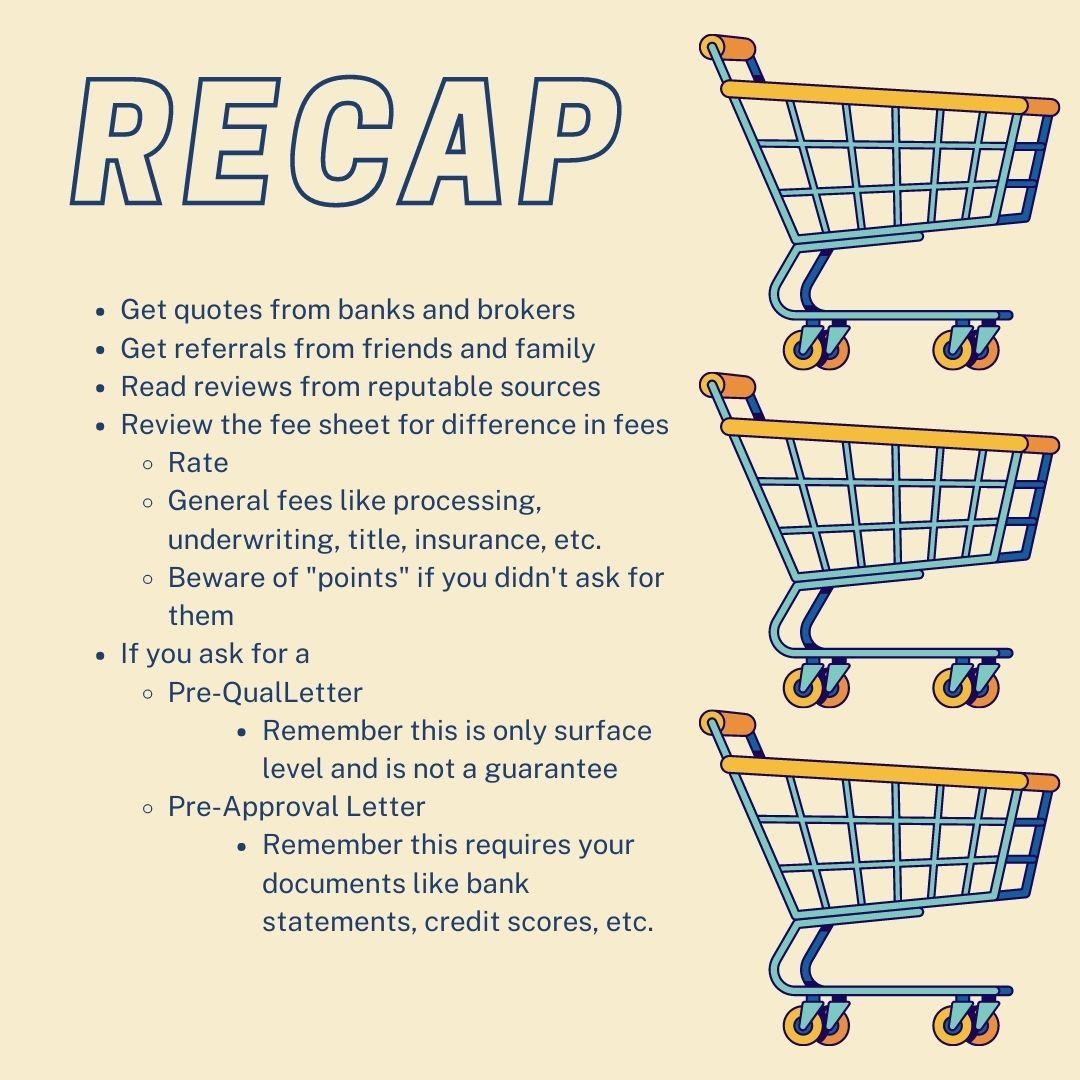

When shopping for a home loan, it pays to look around. It is a good idea to get free quotes from both banks and mortgage brokers. Banks usually offer a variety of products, so it is worth researching what each bank has to offer. Mortgage brokers, on the other hand, have access to a variety of lenders so that they can shop around for the best rate and product for your needs. It is also a good idea to ask for referrals from friends and family who have recently purchased a home. Reading reviews about lenders is also a great way to ensure you get the best deal.

When comparing quotes, it is important to look at all the details. Make sure you compare the interest rates, fees, and points to buy down the rate. Also, ensure you get a fee sheet from each lender to compare terms and conditions. It is also important to understand the difference between a pre-qualification letter vs. a pre-approval letter. For instance, a pre-approval should not be given if you haven’t provided any documentation to the lender.

Finally, make sure you look out for hidden fees or red flags. Some lenders may try to hide certain fees or points in the loan documents. Make sure you read all the documents carefully and ask questions if you have any doubts.

Source: Trident Home Loans

Shopping around for a home loan can seem overwhelming, but it is worth taking the time to research. By getting quotes from banks and mortgage brokers, reading reviews, and looking out for red flags, you can ensure you get the best deal for your needs.

Roy Stephens

MLO | NMLS 2224713

[email protected]

850-972-2452