Marty Medve

COO | Sr. MLO (NMLS 86840)

Marty attended the USNA from 1981-1985 graduating with a BS in Mathematics.

There are many options when it comes to home buying or refinancing. Our Loan Officers are experts

in figuring out which loan will work best for you.

Browse through our loan products and let us know if you have any questions!

Our most popular loan product is the VA loan. We are Veteran Owned & Operated and have 5 Nationally ranked Loan Officer’s on staff, including the # 1 VA Veteran Loan Originator in the country, Per the Scotsman Guide, Marty Medve. In fact a total of 5 of our Mortgage Loan Originators listed in the industry benchmark of rankings.

Our expert staff can guide you through the ins and outs of the VA loan program. For instance, did you know that you can use it more than once? You can actually use it multiple times and you can even use split entitlement so 2 service members can each use half of their benefit to qualify.

If you have served in the Military for more than 90 days you may be eligible for a VA loan. In fact, there are many ways you can qualify, if you were involved with the Military. Veterans, active military personnel, and military spouses who qualify can apply today. The benefits of this loan program is that it is backed by the Government and requires no down payment and no MIP (Mortgage Insurance Premium). The VA loan program does require a funding fee depending on number of uses but if you receive disability benefits – this can be reduced or removed.

To use this loan, you, or your immediate family, must occupy or intend to occupy the residence within a reasonable period. If you use this loan type for a new construction, the builder must be VA approved (Trident Home Loans can help with that) and they must provide a warranty for the build – this is an added benefit to you!

Meet our very own Veteran Owners.

Trident Home Loans was built on the idea that a new direction was needed to succeed. Through trust and a strong focus on customer service, the business continued to grow and succeed. Trident is owned and operated by Veterans that are uniquely qualified to understand the nature and needs of military families. Today we are continuing our growth by expanding to over 25 states and increasing our staff at a rapid rate to ensure that every client receives the attention they so deserve.

Conventional loans are the most popular and most basic loan type. A conventional loan can be used for both purchases and refinances of primary residences, 2nd homes, or investment properties. The most common misconception is that you need a minimum of 20% down and excellent credit. While this is ideal, this is not at all required. If you have a credit score of 680 or higher, that’s great!

Waiting years and years to save that down payment means missing out on so many opportunities. Aside from the fact that you’re just paying someone else’s mortgage when you rent, the housing market can change in an instant. Prices can increase or even double by the time you save what you thought was enough.

There are many varieties of the conventional loan. You can use it as a first-time homebuyer, for purchasing a second home, as an investment, or for refinancing.

Another consideration is your Debt-to-Income ratio (DTI). Common debts like car payments, installment credit cards, child support, alimony, etc. are counted against your paycheck. As long as this ratio is about half, you can still qualify. (This includes the payment for rent or mortgage) If you have a higher DTI and lower credit score, say below 680, FHA might be a better option for loans with a lower down payment.

The best reason to speak to a loan officer about your loan product options is that they can find what would be best for you now. We’re not some big bank with a bottom line; we care about getting you into the home of your dreams.

Conventional Loan Features:

*Higher loan limits may apply in certain counties. Speak to our loan experts today to review your local area for loan limit information.

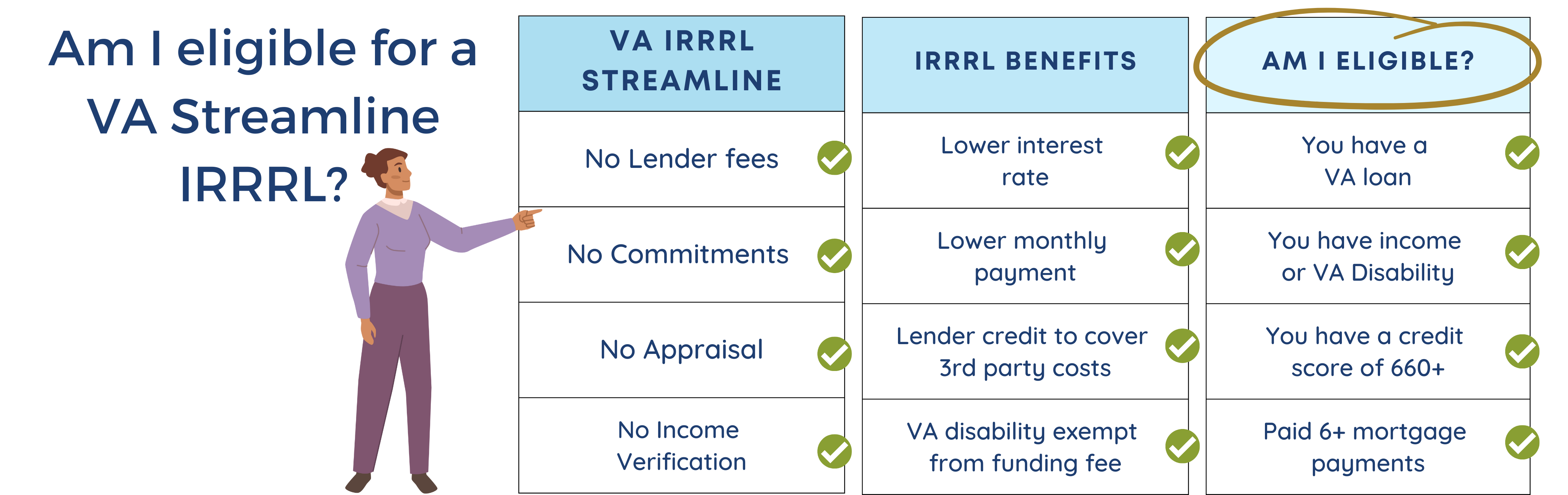

An IRRRL is a type of refinance available to eligible veterans that requires minimum paperwork, and the process is much more streamlined than a regular refinance.

Yes: There are closing costs, such as the VA funding fee, which is .5% of the loan amount. These costs can be financed into the loan

660: You must meet the minimum credit score of 660 in order to qualify for a VA Streamline IRRRL at Trident Home Loans.

No appraisals or income verification are required for a Streamline.

Yes: We cover all of your 3rd party transaction fees with a lender credit.

Yes: Your current escrow account will be refunded within 30 days. You can either finance the escrow or pay it with cash.

Yes: You can get up to $500 with minimal paperwork or you can look into the VA cash-out refinance program instead with full doc

Depending on your location, the term Jumbo might suggest a home that’s larger than life. However, location will define the price point more often than not. Jumbo loans are similar to typical conventional loans, they just require a few additional items.

The base point to qualify for a Jumbo loan depends on the county limits for high-balance homes. Typically, over $647,200 is considered a Jumbo. If you have a credit score of over 700, you may qualify. Check for your county loan limits.

Unlike Conventional and FHA loans, there is no MIP available for Jumbo loans. The good news, however, is that you don’t need 20% down. Only 10% is typically required and you may have to show reserves in the bank for a few months.

Jumbo Loan Features:

*Higher loan limits may apply in certain counties. Speak to our loan experts today to Review your local area for loan limit information.

Not willing, ready, and/or able to commit to a standalone single-family dwelling? No problem! Trident Home Loans offers loan products for condos, duplexes, and more.

These are great for first-time homebuyers, city living, vacation properties, and rentals. If you’re thinking of earning some income, starting off with a condo is a great place to start.

Condo products typically have some requirements in addition to the typical loan documents. The condo must be fully completed, including buildings. There should be Condo Owner Association documents, and they should provide proof of insurance in addition to the ‘walls-in’ insurance you will be required to get.

There maybe other considerations as well, so be aware. Trident follows Fannie Mae guidelines when it comes to condos. For example, Fannie Mae will assess to see if the condo falls under “condotel” – in which case, the loan could be denied. This is when the condo is treated more like a short-term rental or hotel type building instead of a residence.

For a full list of requirements and guidelines, check out FannieMae.com

Condo Loan Features:

Yes, you read that right! Trident Home Loans can provide financing to borrowers looking to purchase or refinance a condo. We offer several different condo-financing programs to better assist our borrowers. Contact a loan representative to learn more.

If your credit is less than ideal and/or you have a low down payment amount available, consider a loan through the Federal Housing Assurance program.

The Federal Housing Assurance program is a government-backed program that allows borrowers to finance a home that they normally may not be able to qualify for through conventional means. This type of loan is a mortgage insured by the Federal Housing Administration (FHA).

While this is a popular choice for first time homebuyers, it’s not limited to them. This is a great option for those with less than 20% down or those who have lower credit scores due to financial hardship or bankruptcy, etc. (Bankruptcy requires a seasoning period, so check with your Loan Officer on those details.)

Unlike Conventional loans, FHA requires only 3.5% for the down payment – this makes it easier to buy a home faster than waiting years to save up.

The standard down payment is 20%, so to make up the difference, if you only put down 3.5% – then the other 16.5% is reached with MIP – private mortgage insurance. This is a small fee added on to the monthly payment that is paid until the LTV (Loan To Value) reaches the 80%. This does not always mean that you have to use the amortization schedule to meet your payment deadlines. If your home’s value has increased, after a couple years, you can contact your lender or servicer and with a few requirements such as getting a new appraisal you can request the MIP to fall off. This can take thousands off your final principal.

FHA Loan Features:

To the FHA, reliability includes holding a steady job for at least 2 years with the same employment, increasing or maintaining consistent income, and demonstrating a sufficient credit history. Additionally, any foreclosure or bankruptcy on one’s record has to be at least three years old in order to be able to proceed with this loan program.

Did you know that most of the country actually falls under the option of a United States Department of Agriculture (USDA) loan? More than 95% of the land for sale is USDA eligible. The kicker is that they are usually more rural areas. This doesn’t mean you can’t be near the city, it just means you may be outside city limits. Check the qualification map to see if your desired property qualifies.

Although they are typically more rural areas, this does not always mean farms or rolling acres. This loan product offers assistance in providing low and moderate—income households opportunities to live in a more modest, safe, and private dwelling as a primary residence. (This does not include investment properties.) The applicant must agree to live in this property full time.

This program does not require a down payment but it does require a minimum credit score (620 average) and has income limits. Any and all members of the household can not exceed the income limit. This limit is determined by the location, so check here for more information. The applicant must not exceed 115% the median income in that county – this includes all eligible individuals able to work in the household, regardless if they are on the loan. This includes bonus’, commissions, etc.

USDA Loan Features:

Note that the USDA loan program provides a 90% loan note guarantee to approved lenders in order to reduce the risk of extending 100% loans to eligible rural home-buyers.

Investment properties are meant to produce income for the owner. You can see a return on your investment with the rental income produced, which can pay the monthly mortgage as well as incidentals like repairs and upgrades. You can also achieve ROI with buying a property in an up and coming area – the value will likely go up and you can sell for a profit.

This loan product does require 25% down and if your income alone does not qualify you, you can use the rental income to cover the DTI. Only a conventional loan type will work for this type of property.

Investment Home Loan Features:

This type of conventional loan is reserved for those looking to purchase a property other than those in their immediate area and intending to spend some time there throughout the year.

Although most people opt to find a second home far away from their everyday life, the minimum requirement is only 50 miles away. In some instances, such as a resort or tourist area, you can waive this requirement.

While rental income will not qualify you, it’s okay to also use it for rental income as long as you occupy the house sometime throughout the year. The difference between a second home and the Investment Loan Program is that the down payment is only 10% and MIP is allowed.

Investment Home Loan Features:

Cash Out

If you have equity in the home and would like to take some of that out to make some repairs, pay off some debts, etc. this is a great option. This starts a whole new loan so all terms are updated with this one, including the time left on the loan.

If you have a VA loan, you can take out up to 100% of the equity. If you have a conventional loan, you can take about 85%. This is a great way to pay off old debts that may have higher interest rates, such as your car, credit cards, medical, student loans, etc.

Regular Rate Term Refinance

This is a great option when the rates are generally better or you want to change the loan program, and/or lower or remove MIP. If the rates have dropped and it’s been 2 years since your first payment, you should consider refinancing. This can save thousands on your overall mortgage.

If you have a conventional loan with MIP, you can refinance out of it once your LTV hits 80%. You just have to contact your servicer and possibly do an appraisal to confirm the value and remove it. If you have an FHA with MIP, you can refinance into a conventional loan if you have 3.5% down. After 2 years, you can determine with an appraisal if the LTV has reached 80% and opt to remove the MIP.

There are many great opportunities when it comes to refinancing your home. Call our expert loan officers today to find out how to get started.

VA IRRRL – Interest Rate Reduction Refinancing Loan

If you already have a VA loan, then this could be your answer. If you are looking to lower rate to meet current rate trends then this is a great option. There are only a few qualifying boxes to check and very few documents to provide.

Keep in mind, there is a seasoning period in which you have to have had the current loan for 210 days from the first payment due date. After that, the VA has already qualified you so you don’t have to provide much else. If you are not exempt, there is a funding fee of .5%. Definitely contact our Loan Officer’s for more info today.

We base our success on the words of our clients. We value their opinions and appreciate their

feedback and referrals to their friends and family.