Explain: Interest Rates for Mortgages

Submitted by: Tayler Esping, MLO | NMLS 1884157

Yes you can figure out interest rates! Interest rates are an important part of the home-buying process, so it’s important to understand them. Mortgage interest rates are the percentage of the loan amount that a lender charges you to borrow money. Interest rates vary from lender to lender and depend on a variety of factors, such as your credit score and the type of loan you’re applying for. Generally speaking, interest rates are higher for borrowers with lower credit scores and higher loan amounts. When shopping rates, just looking at the average doesn’t always paint the perfect picture. It’s best to consult with a lender and factor in all your qualifying points. You may receive something lower than the industry average.

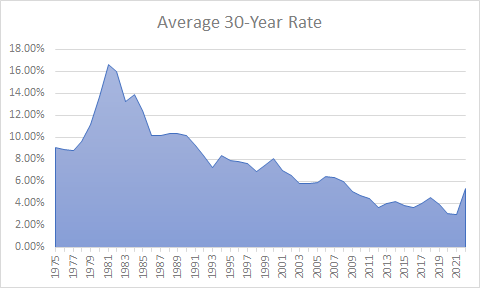

When shopping for a mortgage, you’ll want to compare interest rates as well as fees associated with each loan. Additionally, it’s important to factor in the current market conditions. When interest rates are low, it’s typically a good time to buy a home, as you can lock in a lower rate. We saw the height of this back in 2020. Conversely, when interest rates are high, you may want to wait until they drop. Last year, they spiked back up, but still average to what they were before the drop in 2020. We used to see rates in the 8 -16+% range and thought nothing of it. When they dropped too low 2’s%, it encouraged everyone to refinance or buy a new home. This caused a ripple effect in the market and suddenly your $140k 3 Bed/2 Bath home was worth $300k and you wanted that equity in your pocket or to be used as a downpayment for something better. So, with all the people wanting to make that change, the number of houses became fewer and fewer and at the same time, the cost of the available houses skyrocketed and people were no longer able to afford that new option.

Source: FreddieMac

Right now, rates are leveling out, we are seeing a pretty steady range and a couple of small spikes in either direction. We are also seeing more reasonably priced homes again. This means, if you want to and can afford to, now is always a good time to buy. If the rates get worse, you can avoid that mess. If the rates get better, well all you have to do is wait a typical 6 months of payments after your purchase, then you can refinance. There are no limits to refinancing. You can continue to drop your rate if the market improves.

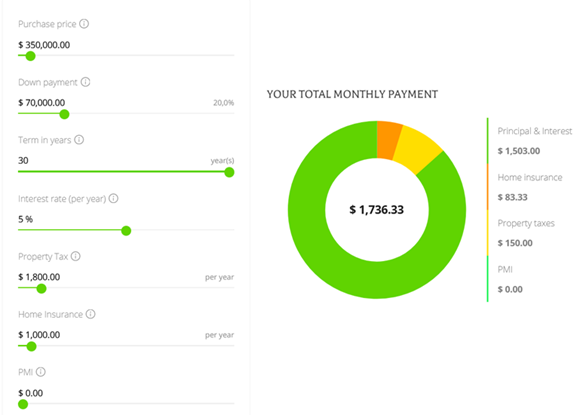

Source: Trident Home Loans, Calculator

It’s also a good idea to consider a loan’s APR, or Annual Percentage Rate. This figure includes the interest rate and any fees associated with the loan, and it’s a good way to compare different lenders.

Finally, be sure to do your homework and shop around. A good lender will be able to provide you with personalized advice and guidance and help you find the best interest rate and loan terms for your situation. Good luck!

TAYLER ESPING

MLO | NMLS 1884157

[email protected]

Apply or Contact me today!