Interest Rates are on the Rise

If you’ve watched the news lately, or just genuinely not had your head in the sand, you’ve heard that the Federal Reserve has raised the interest rate to stop the growth of monetary inflation. This generally translates to higher interests rates for all types of consumer loans, including mortgages, but how does that apply to home buying? Is it time to panic? Home mortgage loans are based on mortgage backed securities and are set by various investors in the secondary market. It’s a fact that most banks sell off the loan to the secondary investment market in order to regain the capital they loaned you. Mortgage Backed Securities are similar to a bond and are made up of a bundle of home loans bought from the banks that issue them.

So how do you follow this trend? The 10 year Treasury Yield Future index is a good benchmark index that rate trends tend to follow. Looking at the graph below, we’ve seen historically low index rates over the past ten years, but absolutely unprecedentedly low rates since 2019. With this recent trend in mind, it’s easy to feel like the sky is falling, with rates rising over 2% in a single quarter. When looking with a broader view and comparing today to historical interest rates, you still see numbers well below the 40 year average. This is a good thing for borrowers. Not free money, but not a cause for panic either. Borrowers concerns should further be assuaged when looking at the relative home value increases across the nation over time.

Home Values are Also on the Rise

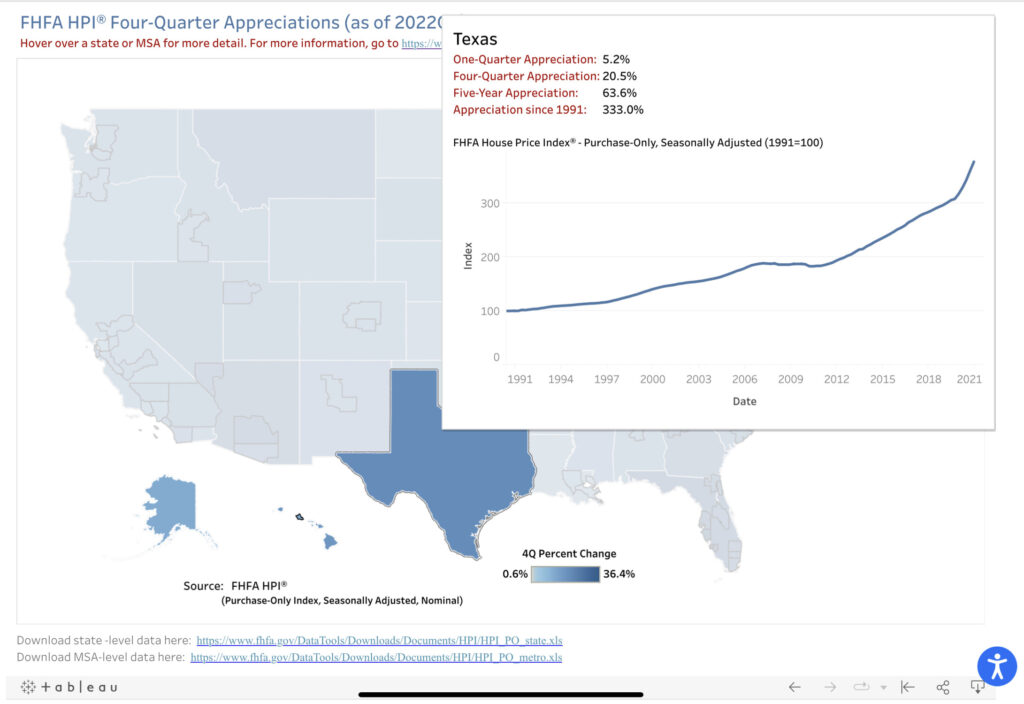

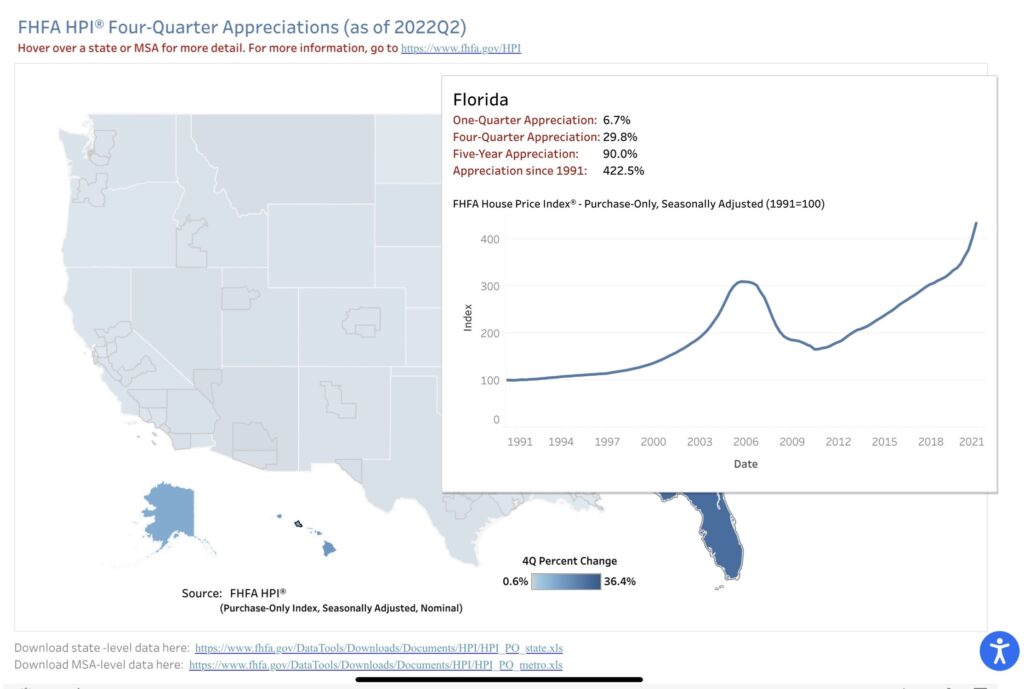

Again…if you’ve been paying attention, home value increases aren’t a surprise to you. If you’ve owned property, you’re likely well aware and are sitting happy in your home with its increased value. If you’re searching for a home, you know the frustrations of constantly rising home prices. It’s true, the price of homes across America have risen sharply over the past year. According the the Federal Housing Finance Agency, the average home price appreciated 18.7% last year. The rapidly inflated value across America has largely been attributed to two major things, consumer demand and home availability. Numbers in several key markets like Florida and Texas have seen an average home value jump 29.8% and 20.5% respectively. In ONE YEAR!

When taking a five year snapshot according to the same data, the average American home has continued to appreciate averaging 59.8% nationally. In certain key markets, numbers are significantly greater still. In Texas, the average property value has risen nearly 64% in that same timeframe. Florida’s home values have almost doubled at 90% over their five year previous value. There’s more good news in these numbers for consumers who have owned their property over a 30 year period. The national average home value increased 275%. In Florida, the resulting home value has grown 422%. Doing the math, that equates to an annual home appreciation of 9%! This is a good news story.

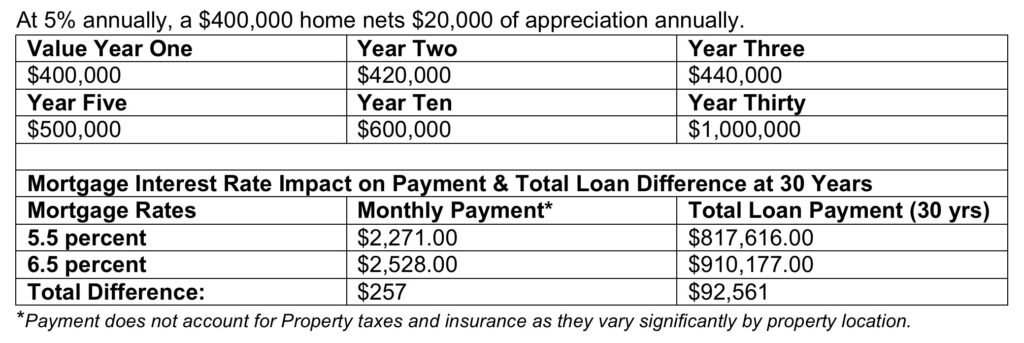

Ok, so far I’ve thrown out a bunch of hard data without any significant connection or benefit to you. Below, I’ll draw a practical application for you to consider To make the math easy, we’ll use the conservative number of 5% average home appreciation annually. (Undersell and over deliver)

Doing the Math

Baseline Numbers: $400,000 home, 30 year Mortgage, 5.5% Interest Rate, 6.5% Interest Rate.

It doesn’t take a rocket surgeon to see those numbers adding up in a practical scenario, making big sense financially. The home you buy for $400,000 today will be valued at $1M in 30 years. Locking in an interest rate 1% lower saves you $92,000 of equitable value over a 30 year period. Buying at a lower interest rate saves you future earnings, but both interest rates shown above net you a gain at the 30 year mark. Even at 6.5 percent your home has increased significantly in value. These numbers get better by paying more than your monthly payment.

Just as home values increase, inflation also works in a positive manner over the long run with income earnings. Today’s income will not be tomorrow’s. Locking in rates at today’s prices saves you money in the long term. Plus with a company like Trident, we’re committed to our borrowers long term success. We’re constantly looking-out for you through the life of your ownership in your property, and when rates fall(the bond market is cyclical, just like the stock market) we’re here to help save you money with refinancing your loan to a lower rate. This will save you huge equity in the long term. One thing we do know, you won’t be locked into these rates forever. The sky is definitely not falling, and there’s never been a better time than today to get started!

-Dave Jeltema, Licensed Mortgage Loan Originator, for Trident Home Loans

#mortgagelender #mortgagetips #realestateadvice #mortgagerates #mortgages #mortgagespecialist