Submitted by:Dustin Witt, MLO | NMLS 2486233

Navigating the Mortgage Landscape: From 200k to 400k Homes

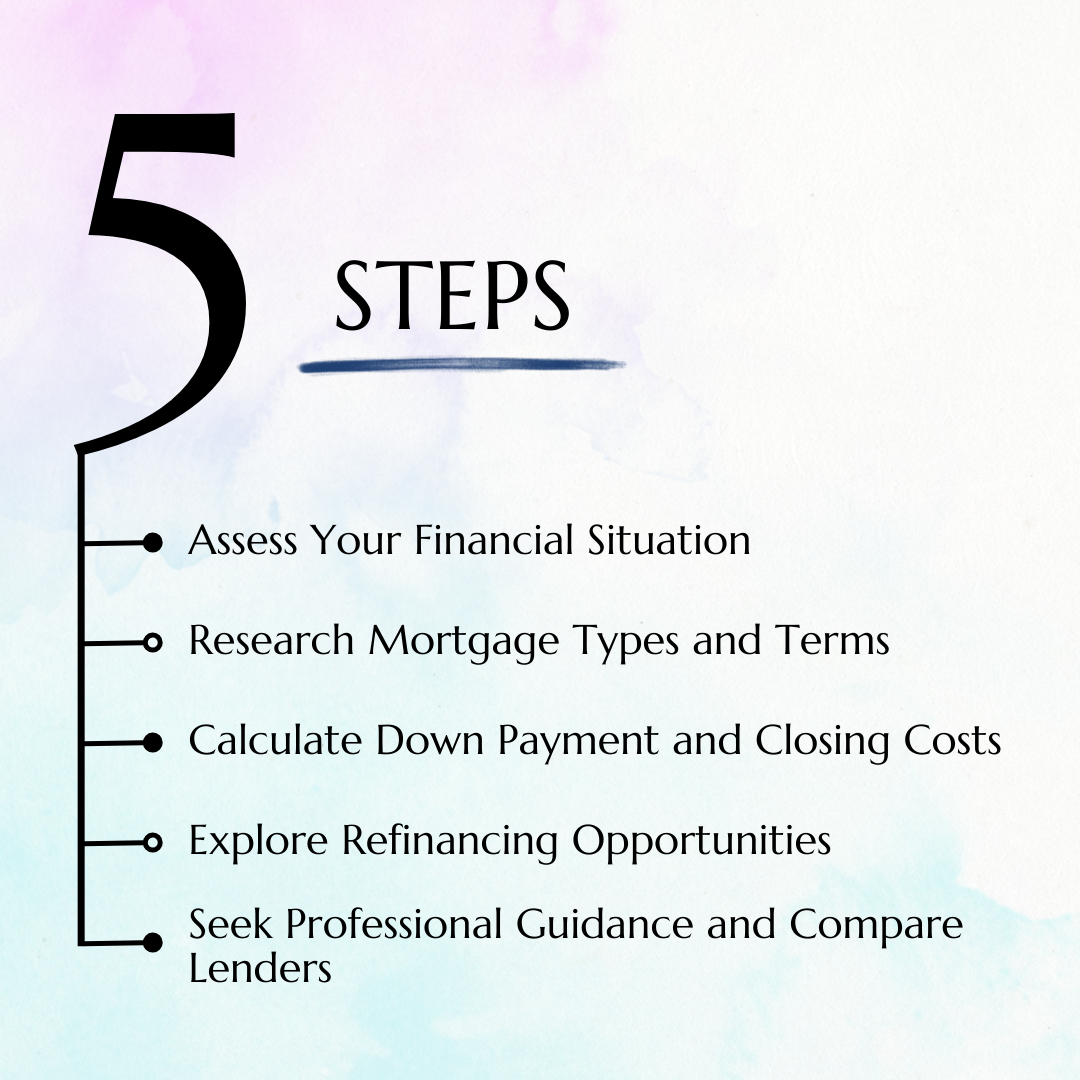

In the realm of homeownership, financial decisions hold the key to securing your dream abode. Whether you’re considering a modest 200k house or a more opulent 400k mortgage, comprehending the intricate world of mortgages and refinancing options is paramount. This in-depth guide will not only explore the dynamics of obtaining mortgages but also shed light on the optimal timing for home loan refinancing. Furthermore, we will unravel how secondary homes align with Fannie Mae guidelines and introduce you to some of the top-tier home loan refinance companies in the market.

Understanding Mortgages: From 200k Houses to 400k Mortgages

Purchasing a home is one of the most monumental financial decisions you’ll ever make. Whether you have your sights set on a cozy 200k house or aspire to secure a 400k mortgage for a more spacious property, we’ll delve deep into the nuances of mortgage types, terms, and down payment considerations. This will empower you with the knowledge needed to make an informed choice that aligns with your financial aspirations.

When considering a 200k house, it’s essential to evaluate your budget and the mortgage options available. The 200k house may be the perfect fit for first-time buyers or those looking for a smaller, more affordable property. Mortgages for these homes typically come with lower monthly payments and down payment requirements. On the other hand, if you’re setting your sights on a 400k mortgage, you’re likely exploring larger, more luxurious homes. These mortgages often come with different terms and eligibility requirements, which we’ll explore in detail.

Timing Is Everything: When to Refinance Your Home

For homeowners who have already taken the leap into homeownership, the question of when to refinance a home often looms large. We’ll conduct a comprehensive exploration of the key factors that influence this critical decision. From fluctuations in interest rates to the impact of altering loan terms, we’ll help you navigate the intricate process of refinancing, whether you’re considering a refinance of your VA home loan or a conventional mortgage.

To better understand the ideal timing for refinancing, it’s crucial to consider your financial goals and market conditions. When interest rates drop significantly, it often presents an opportunity for homeowners to refinance their mortgages for better terms and lower monthly payments. This can be especially advantageous for those with a 400k mortgage, as even a small reduction in interest rates can result in substantial savings over the life of the loan. However, the decision to refinance should align with your long-term financial objectives, whether you’re managing a 200k house or a 400k mortgage.

Exploring Second Homes and Fannie Mae Guidelines

The allure of a second home is undeniable, but how does it fit into your financial portfolio? We’ll shine a spotlight on Fannie Mae guidelines for second homes, providing you with the insights necessary to navigate this intricate landscape. Whether you’re contemplating a vacation retreat or an investment property, we’ve got you covered with comprehensive information and guidelines.

Investing in a second home, whether it’s a cozy cottage by the beach or a mountain cabin, is a dream for many. However, financing a second home can be more complex than obtaining a primary residence mortgage. We’ll explore the various financing options available for second homes, including how Fannie Mae guidelines impact your choices. Whether you’re interested in using the property for personal enjoyment or as a source of rental income, understanding the guidelines for second homes is crucial to making informed decisions.

Source: Trident Home Loans

Finding the Best Home Loan Refinance Companies

When it comes to refinancing your mortgage, selecting the right lender is paramount. We’ll not only introduce you to some of the best home loan refinance companies but also engage in an in-depth discussion about their strengths, services, and how they can help you achieve your refinancing objectives. Armed with this knowledge, you can confidently choose the partner that best aligns with your unique financial goals.

The process of refinancing your mortgage, whether it’s for a 200k house or a 400k mortgage, can be streamlined with the right lender. We’ll provide you with insights into what to look for in a refinance company, including their reputation, customer service, and competitive rates. Additionally, we’ll discuss how these lenders can assist you in navigating the complexities of the refinancing process, ensuring that you secure the best possible terms and rates.

Conclusion: Your Mortgage, Your Home

Whether your homeownership dreams encompass a mortgage for a 200k house or involve the financial commitment of a 400k mortgage, the world of real estate is within your reach. By acquiring a profound understanding of the intricate nature of mortgages, discerning the opportune moment for refinancing, and exploring the possibilities presented by secondary homes, you can embark on your homeownership journey with unwavering confidence. With the guidance of the best home loan refinance companies, your financial aspirations are not just dreams – they are on the verge of becoming reality.

As you embark on your journey to homeownership, remember that the choices you make regarding your mortgage and refinancing options can have a profound impact on your financial future. Whether you’re considering a 200k house or a 400k mortgage, it’s essential to be well-informed and work with reputable professionals who can guide you through the process. With the right knowledge and support, you can achieve your homeownership goals and secure a bright financial future.