Submitted by: John Fisher, MLO | NMLS 2054424

Understanding Private Mortgage Insurance PMI Its Purpose and Strategies for Elimination

Private Mortgage Insurance (PMI) can play a significant role in the homebuying process, but it’s essential to grasp its purpose and explore effective strategies for eliminating it. In this comprehensive guide, we will delve into the intricacies of PMI, how it impacts your mortgage, and the various methods to get rid of it, ultimately saving you money.

What is Private Mortgage Insurance (PMI)?

PMI, or Private Mortgage Insurance, is a type of insurance that lenders often require from homebuyers who make a down payment of less than 20% of the property’s value. Its primary purpose is to protect the lender in case the borrower defaults on the loan. While PMI provides some level of security for lenders, it’s an additional cost for borrowers and can significantly impact the overall cost of homeownership.

Understanding the Importance of PMI

- A Helping Hand for Low Down Payments: PMI offers flexibility for prospective homebuyers who can’t afford a substantial down payment. By paying a monthly PMI premium, borrowers can qualify for a mortgage with a lower upfront investment.

- Enabling Homeownership Sooner: For first-time homebuyers and those with limited savings, PMI allows earlier entry into the housing market, providing an opportunity to build equity and invest in homeownership.

- Increased Lender Confidence: With PMI in place, lenders may feel more secure when offering mortgages to borrowers with smaller down payments, as the insurance mitigates some of the financial risks associated with such loans.

Costs Associated with PMI

Understanding the costs of PMI is crucial for making informed decisions about homeownership. Consider the following aspects related to PMI expenses:

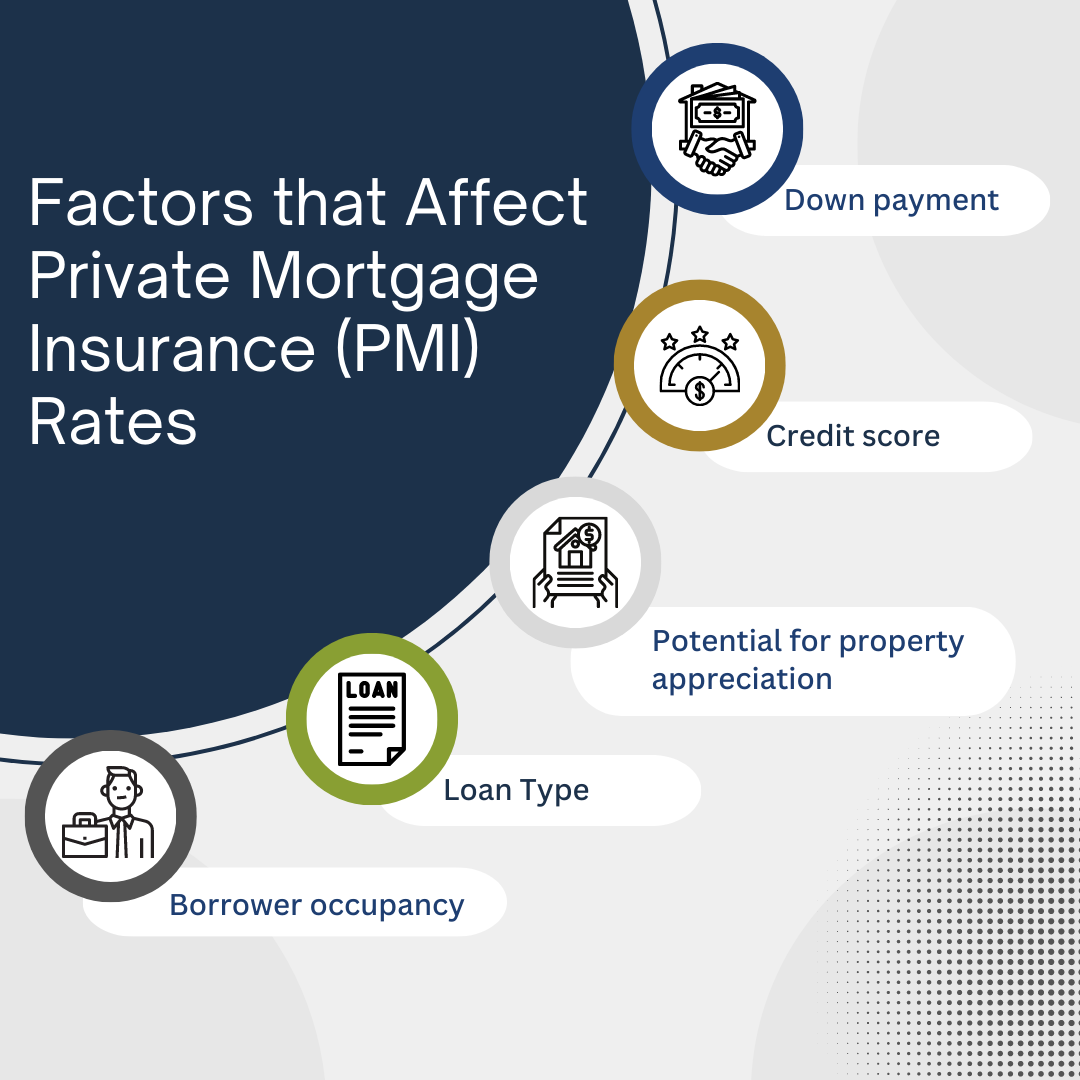

- PMI Premiums: The cost of PMI can vary based on factors like the loan amount, credit score, and down payment percentage. Typically, PMI premiums range from 0.3% to 1.5% of the original loan amount per year.

- Payment Duration: PMI is usually required until the borrower has accumulated enough equity in the home, typically reaching an 80% loan-to-value ratio. This means that if you initially made a 10% down payment, you’ll need to pay off at least 10% more of the home’s value to request PMI removal.

Strategies for Eliminating PMI

While PMI serves a purpose, it’s natural for borrowers to explore ways to eliminate this additional expense. Here are several effective strategies:

- Reach the 20% Equity Threshold: Paying down your mortgage balance and allowing your home’s value to appreciate can help you reach the magical 20% equity mark. Once you achieve this milestone, you can request your lender to cancel PMI.

- Home Improvements and Appraisal: If you believe that your home’s value has increased significantly due to improvements or favorable market conditions, consider getting an appraisal to verify whether your equity position has reached the 20% threshold.

- Refinancing to Ditch PMI: If your financial situation has improved since you initially bought the house, you might qualify for a mortgage refinance. With a lower loan-to-value ratio, you can refinance into a new loan without PMI.

Reappraisal Due to Home Improvements: Significant home improvements that increase your property’s value may qualify you for a reappraisal. If the new valuation pushes your equity above 20%, you can ask your lender to cancel PMI.

Source: Trident Home Loans

The Path to PMI Elimination: Making Informed Choices

Private Mortgage Insurance can serve as a stepping stone for aspiring homeowners, making homeownership more accessible. However, understanding its implications and knowing the strategies to eliminate PMI can empower borrowers to save money and accelerate their journey towards true homeownership.

In conclusion, PMI offers opportunities for individuals to achieve their homeownership dreams with smaller down payments. It provides lenders with an added layer of protection, making it more feasible for them to extend loans to buyers with limited savings. Nevertheless, borrowers should be proactive in reaching the 20% equity threshold and exploring viable options for PMI removal. By staying informed and making strategic financial choices, homeowners can navigate the world of PMI with confidence and achieve long-term financial stability.

John Fisher

John Fisher

MLO | NMLS 2054424

[email protected]

Website

(410) 693-7407

Apply or Contact me today!