Exploring USDA Loans: A Great Option for Homebuyers in Rural Areas

Submitted by: Mena Caballero, MLO | NMLS 1898224

When it comes to buying a home, many potential buyers are unaware of the various financing options available to them. One such option that has been gaining popularity in rural areas is the USDA loan. In this blog post, we will dive into the details of USDA loans, their benefits, eligibility criteria, and the application process. By the end, you’ll have a comprehensive understanding of why a USDA loan could be the perfect fit for your home buying journey.

What is a USDA Loan? A USDA loan, backed by the U.S. Department of Agriculture, is specifically designed to assist low to moderate-income families in purchasing a home in designated rural areas. These loans come with several attractive features, making them an appealing choice for many buyers.

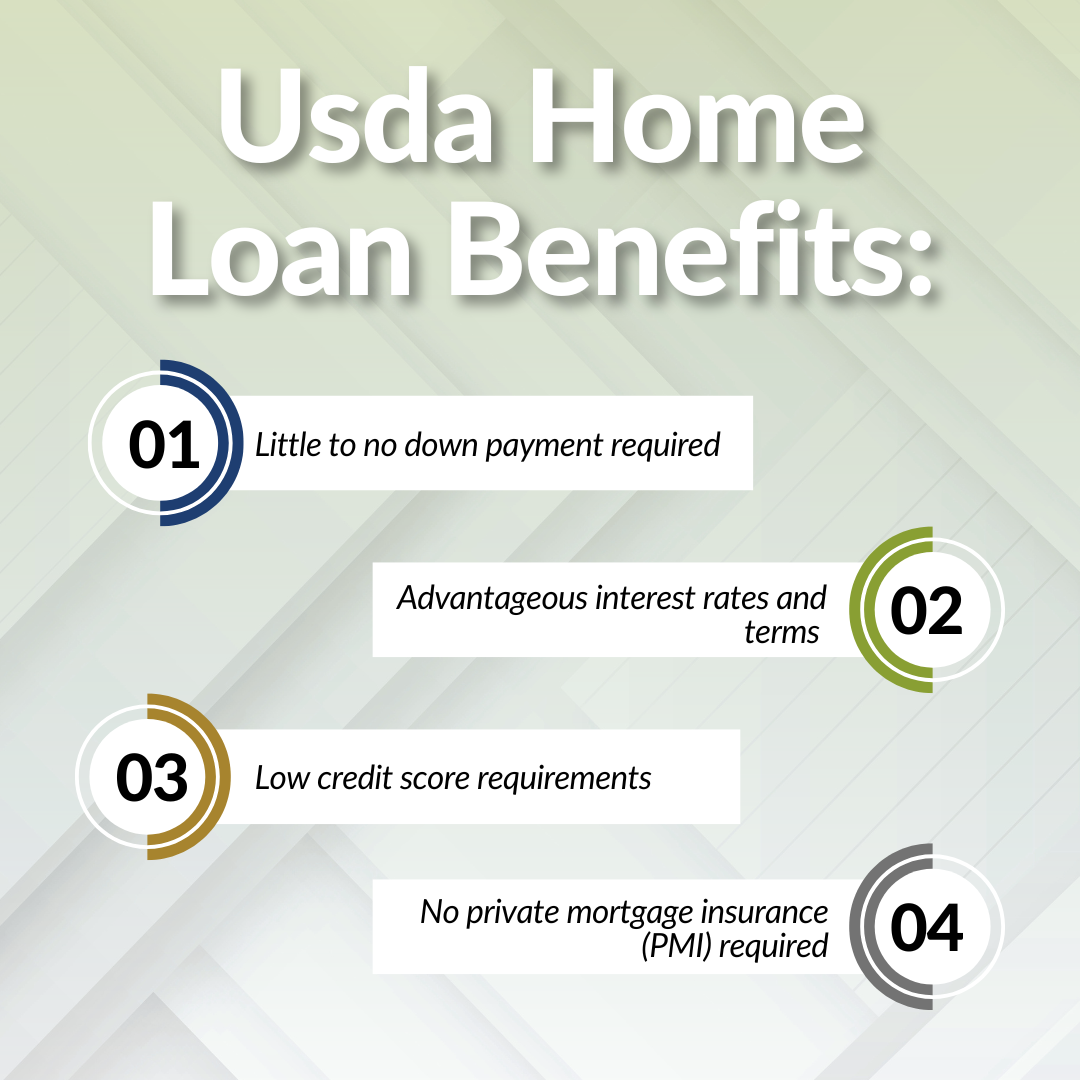

Benefits of USDA Loans: One of the most significant advantages of USDA loans is that they offer 100% financing, meaning borrowers do not have to provide a down payment. This feature eliminates a significant barrier to homeownership, especially for those who may struggle to save for a down payment.

Additionally, USDA loans often come with competitive interest rates, making them an affordable choice for many buyers. The flexible credit requirements further expand the pool of eligible borrowers, accommodating individuals with varying credit histories.

Another appealing aspect is that USDA loans do not require private mortgage insurance (PMI). This saves borrowers additional costs, making homeownership more accessible and affordable in the long run.

Eligibility for USDA Loans: Contrary to popular belief, USDA loans are not exclusively reserved for farmers or those involved in agricultural work. Anyone who resides in a designated rural area can be eligible for a USDA loan. The USDA has specific guidelines to determine which areas qualify as rural, and it’s crucial to work with a knowledgeable real estate agent and loan officer who can help you identify eligible locations.

In terms of income eligibility, your income cannot exceed 115% of the median income for the area. However, there may be exceptions to this rule, so it’s always worth checking with a loan officer to explore your options further.

Application Process: The application process for a USDA loan is similar to that of any other mortgage. Borrowers will need to provide documentation of their income, assets, and credit history. The property being purchased must also meet USDA safety and sanitation standards.

While the duration of the process can vary, USDA loans are generally known for their relatively faster processing times compared to other mortgage types. However, it’s important to keep in mind that thorough underwriting will still be conducted to ensure all requirements are met

Source: Trident Home Loans

USDA loans provide a fantastic opportunity for homebuyers in rural areas to fulfill their dream of homeownership. With 100% financing, competitive interest rates, flexible credit requirements, and no need for private mortgage insurance, USDA loans offer a range of benefits that make them an attractive option for many families.

However, it’s essential to consider all factors involved in the homebuying process, such as the property’s location and your financial situation. Consulting with a trusted real estate agent and loan officer who have experience with USDA loans is crucial to navigate the application process successfully.

By educating yourself on the options available to you, like USDA loans, you can make an informed decision that aligns with your needs and goals. Remember, homeownership is within reach, even in rural areas, and the USDA loan program can help you turn your dream of owning a home into a reality

Mena Caballero

Mena Caballero

MLO | NMLS 1898224

[email protected]

Website

(850) 972-1174

Apply or Contact me today!