VA IRRRL Rates Today Everything You Need to Know in 2025

VA IRRRL Rates Overview

The VA Interest Rate Reduction Refinance Loan (IRRRL), often called the VA streamline refinance, is one of the most popular benefits available to eligible veterans and active-duty service members. This program allows borrowers to refinance an existing VA loan into a new one with a lower interest rate and better repayment terms.

The main purpose of the VA IRRRL is to help military families reduce monthly payments, stabilize their mortgage, and take advantage of favorable market conditions. Because it requires less paperwork than a traditional refinance, it’s considered a fast and cost-effective way to adjust your mortgage.

VA IRRRL Program

The VA IRRRL program was designed to make refinancing as simple as possible. Unlike traditional refinancing, it typically:

-

Requires no appraisal (in most cases)

-

Involves minimal documentation

-

Doesn’t require out-of-pocket closing costs (these can be rolled into the loan)

For many veterans, this means they can lower their rate quickly without the stress of long approval processes.

Current VA IRRRL Rates

As of today, current VA IRRRL rates are competitive with some of the lowest refinance options in the market. Rates vary depending on:

-

Credit score

-

Loan-to-value (LTV) ratio

-

Lender pricing policies

-

Market conditions

On average, VA IRRRL rates run 0.25–0.50% lower than conventional refinance options because they are backed by the Department of Veterans Affairs.

IRRRL VA Loan

The IRRRL VA loan is strictly for borrowers who already have a VA-backed mortgage. It cannot be used to purchase a home; it’s only for refinancing. Key requirements include:

-

You must currently have a VA loan.

-

You must certify that you lived in the home (occupancy requirement).

-

The new loan must result in a net tangible benefit (e.g., lower monthly payment, shorter term).

Best VA IRRRL Rates Today

Finding the best VA IRRRL rates today requires comparing multiple lenders. Each lender sets its own rates and fees, so shopping around can save thousands of dollars over the life of your loan.

USAA VA IRRRL Rates

USAA is one of the most recognized lenders for military families. They frequently offer competitive VA IRRRL ratesand simplified processes for existing USAA members. Many borrowers highlight their strong customer service and transparency.

VA IRRRL Enhancement Program

Some lenders offer enhancements such as:

-

Reduced origination fees

-

Streamlined digital applications

-

Extra flexibility on credit score requirements

These VA IRRRL enhancement programs can make refinancing even more accessible.

VA IRRRL Rates Navy Federal

Navy Federal Credit Union is another top choice. With membership limited to military families, they often provide exclusive VA IRRRL rates that are lower than national averages. Members also report that closing times are faster compared to large banks.

What Is a VA IRRRL?

The term “VA IRRRL” can sound confusing, but it simply means a streamlined refinance loan for veterans.

VA IRRRL Meaning

IRRRL stands for Interest Rate Reduction Refinance Loan. Its goal is to reduce your interest rate, monthly payment, or both.

VA IRRRL Guidelines

The VA has clear guidelines for this program:

-

The loan must be used to refinance an existing VA loan.

-

The new interest rate must generally be lower.

-

Borrowers cannot receive cash back (except up to $500 for minor adjustments).

-

A funding fee of 0.5% applies, unless you are exempt (e.g., disability rating).

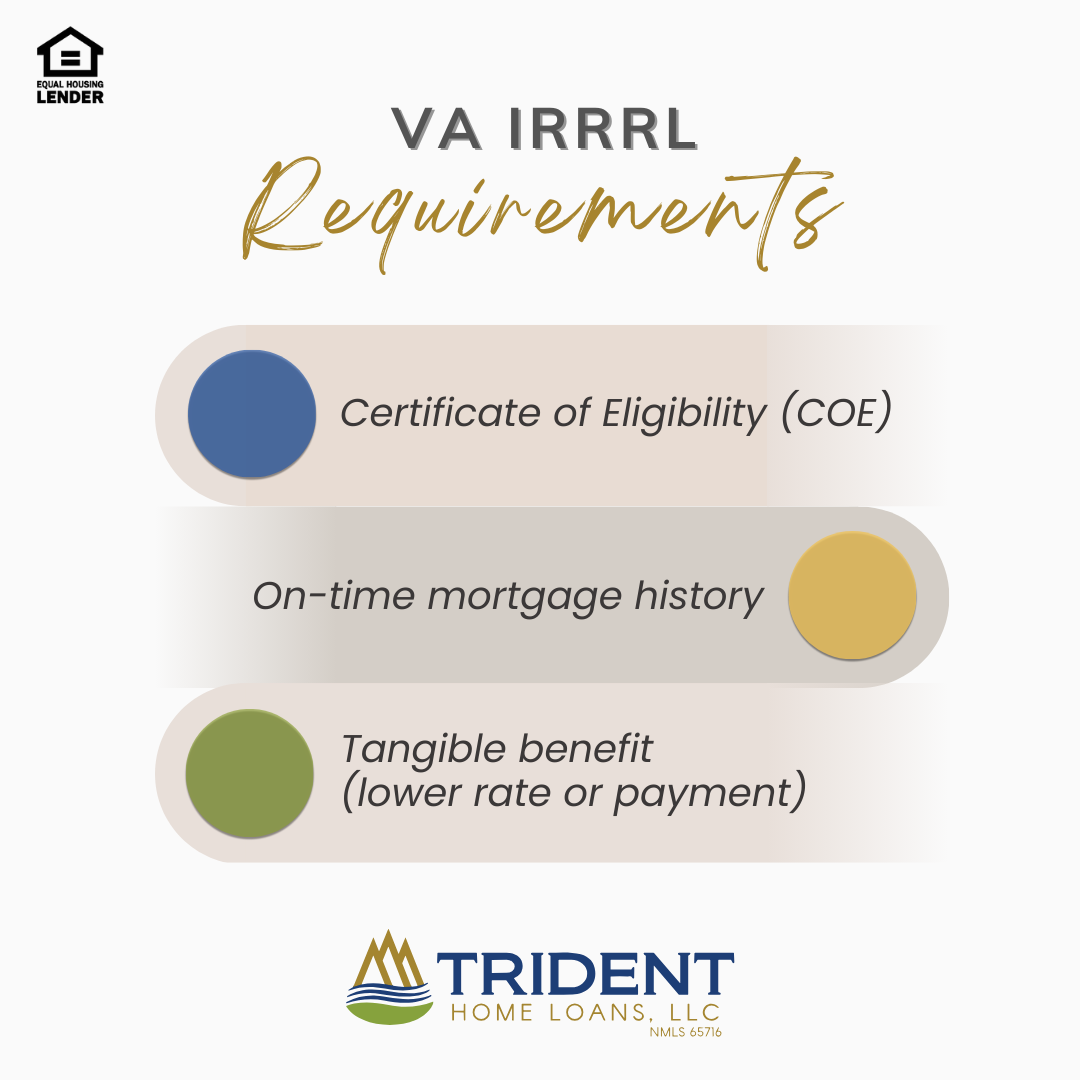

VA IRRRL Requirements

To qualify, you need:

-

A history of on-time mortgage payments

-

A Certificate of Eligibility (COE) (your lender can often retrieve this)

-

Proof that the refinance provides a tangible financial benefit

Tools and Resources for Borrowers

VA IRRRL Calculator

A VA IRRRL calculator can help you estimate savings. By entering your current loan balance, rate, and potential new rate, you can see how much your monthly payments may decrease. Many lenders provide free calculators online.

VA IRRRL Loan Examples

VA IRRRL Loan Examples

For example:

-

A veteran with a $250,000 loan at 6.5% interest could refinance to 5.5% and save around $160 per month.

-

Over 30 years, that equals nearly $58,000 in total savings.

VA IRRRL Refinance

Refinancing through a VA IRRRL is often the smartest move for veterans during periods of falling interest rates. It reduces costs, increases financial flexibility, and ensures long-term savings without excessive upfront fees.

Conclusion

The VA IRRRL refinance program remains one of the most powerful tools for veterans in 2025. With today’s competitive VA IRRRL rates, borrowers can lock in significant savings while avoiding the heavy documentation of conventional refinancing.

If you are a veteran or service member with an existing VA loan, it’s worth exploring whether the current VA IRRRL rates today could benefit you.

Source: Trident Home Loans