Your Credit Score: And how it is Composed

Written by: Elena El Khoury

With contributions from Nikkie Galvan

We all love a good story, and lenders/creditors love to see one on your credit report. It is similar if your friend asks you to lend them money. Wouldn’t you want to know your chances of getting your money back?

If you’re interested in getting a mortgage loan, you should know that credit history and credit score are some of the first items lenders will consider to determine your eligibility. Depending on the loan program, you may need to exceed a specific credit score to get approved. Credit reporting agencies rate certain factors on your credit report to assess the risk of extending a loan and the probability of repayment. For example, the better the credit score, the lesser the risk of lending money. In turn, the better the chances of getting pre-approved for a quality loan are. Your credit score can impact the terms of your loan and may affect your interest rate, down payment amount (if one is required), and more! You will want to keep consistent credit history, especially when you are about to make one of the most important purchases in your life.

Creditors will report your data to 3 credit reporting agencies, Equifax, TransUnion, and Experian. Some creditors will report to all three, and some will report to only one or two. Credit reporting agencies then analyze received data through mathematical algorithms and produce a credit score.

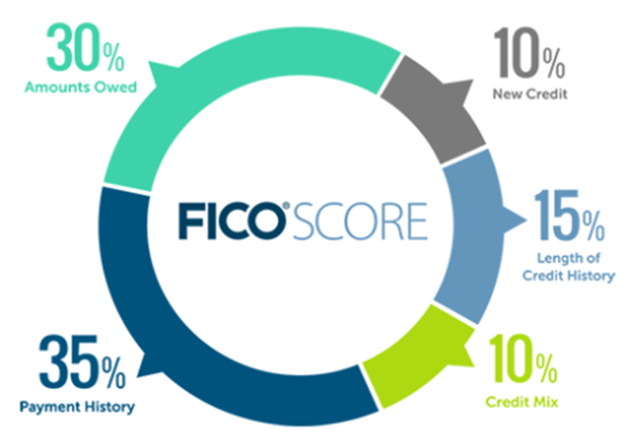

Currently, there are five main factors used in calculating your credit score. Below is a guide to help you understand those factors and gain knowledge on how to stay on top of your credit score dynamics and achieve that perfect score. Let’s take a look at these factors as they are presented in this pie chart below and see below details outlining how much effect each category has on your credit score: outlining how much effect each section has on your credit score:

Payment History (35%):

Payment history is the most important factor affecting your credit score and accounts for 35%. Having just one missed payment can hurt your credit score. The first thing any lender will question is whether you are responsible for making your monthly payments promptly. If you miss a payment, it will remain on your credit report for the next seven years, even if you pay your past-due balance. The more recent, frequent, and severe negative items have a bigger impact on your credit score.

Amounts Owed (30%):

The utilization ratio is another factor contributing to your credit score calculation, accounting for 30% of your overall score. This ratio is between the amounts you owe, or your credit balances, versus how much you have available on your loans and other credit accounts. Generally, you may want to keep your combined balances relative to combined credit limits under 30%. This ratio will have a neutral effect on your credit score. If you manage to keep this ratio under 10%, it will help improve your credit score. If you keep your balances at 0%, credit reporting agencies will look at it as you don’t trust yourself to use credit, so it is a good thing to carry some balance. If you tend to pay your balances monthly, make sure to have them carry over to the next cycle. Creditors report data to credit reporting agencies once a month, and if you pay your balances off before the cycle closes, it will report as $0. This may result in NO credit score as the agencies will not have enough data to analyze your credit utilization behaviors.

Length of credit history (15%):

Having a longer credit history is not required for a good credit score but it accounts for 15%. As you get older, your credit history will improve as you build more. Closing an account can temporarily drop a couple of points off your credit score. Also, don’t close a credit card with a long history even if you do not use it. FICO scores account for the age of your oldest and newer accounts, and the average age of all accounts.

Credit Mix (10%):

Creditors want to see your proven ability to balance multiple credit account types, such as revolving credit card accounts, installment loans, and mortgage accounts, to name a few. Credit mix makes up only a small portion of your credit score – 10%. If you think you need to open up another credit account type, you may want to think of the hard inquiries the creditor will make on your credit report. Will it be worth it?

New Credit (10%):

For the remaining 10%, FICO scores consider the number of new accounts you are applying for. An active application for credit will result in a hard inquiry that can negatively impact your credit score. These inquiries will remain on your credit for 24 months, although FICO will only consider the last 12 months when calculating your credit score. Generally, you want to open new accounts slowly over an extended period. Please note that rate shopping is treated differently. FICO scores will ignore inquiries made in the 30 days before scoring as long as these inquiries were for the same type of credit, like a mortgage.

Now that we covered some basics about credit score composition, let’s talk about credit scoring models. Each industry will want to see the factors of the credit score that are pertinent to them. So, when you pull a credit score through Credit Karma, your will receive your Vantage Score, which is different from the FICO score models used in mortgage lending. For example, credit card companies will use FICO score model 8, while mortgage lenders will want to see FICO score models 2, 4, or 5.

In October 2022, FHFA (Federal Housing Finance Agency) announced that new scoring models, VantageScore 4.0 and FICO 10T, have been approved, which will use trending data in addition to the previous factors. Trending data will provide creditors additional information about your money habits by considering the trend of your balances. If your balances are trending to rise over time, you might notice a decrease in your score and vice versa. There has not been a set date for the transition, and it will take some time to integrate this model into the mortgage lending processes. Make sure you check your credit regularly and understand what you need to do to improve your scores. Checking your credit score is a soft inquiry, which does not affect your credit score negatively.

A good credit score increases the likelihood of qualifying for a mortgage and can help you get the best interest rate on the market.

When you are ready to find out how much you would be pre-approved for a home purchase and what steps you need to take to match you with the best products and rates, talk to an experienced mortgage professional. At Trident Home Loans, we are committed to providing you with the best experience and pride ourselves in helping you find solutions to your home ownership challenges. Call us at 850-343-0400 to speak with any of our loan officers or visit our website tridenthomeloans.com to apply today!