In the quest for homeownership, veterans have unique advantages, and VA mortgage lenders are here to guide them. From securing a VA loan guaranty to exploring VA-approved homes, let’s delve into the comprehensive support available to veterans.

VA Loan Guaranty: Unlocking Homeownership for Veteran

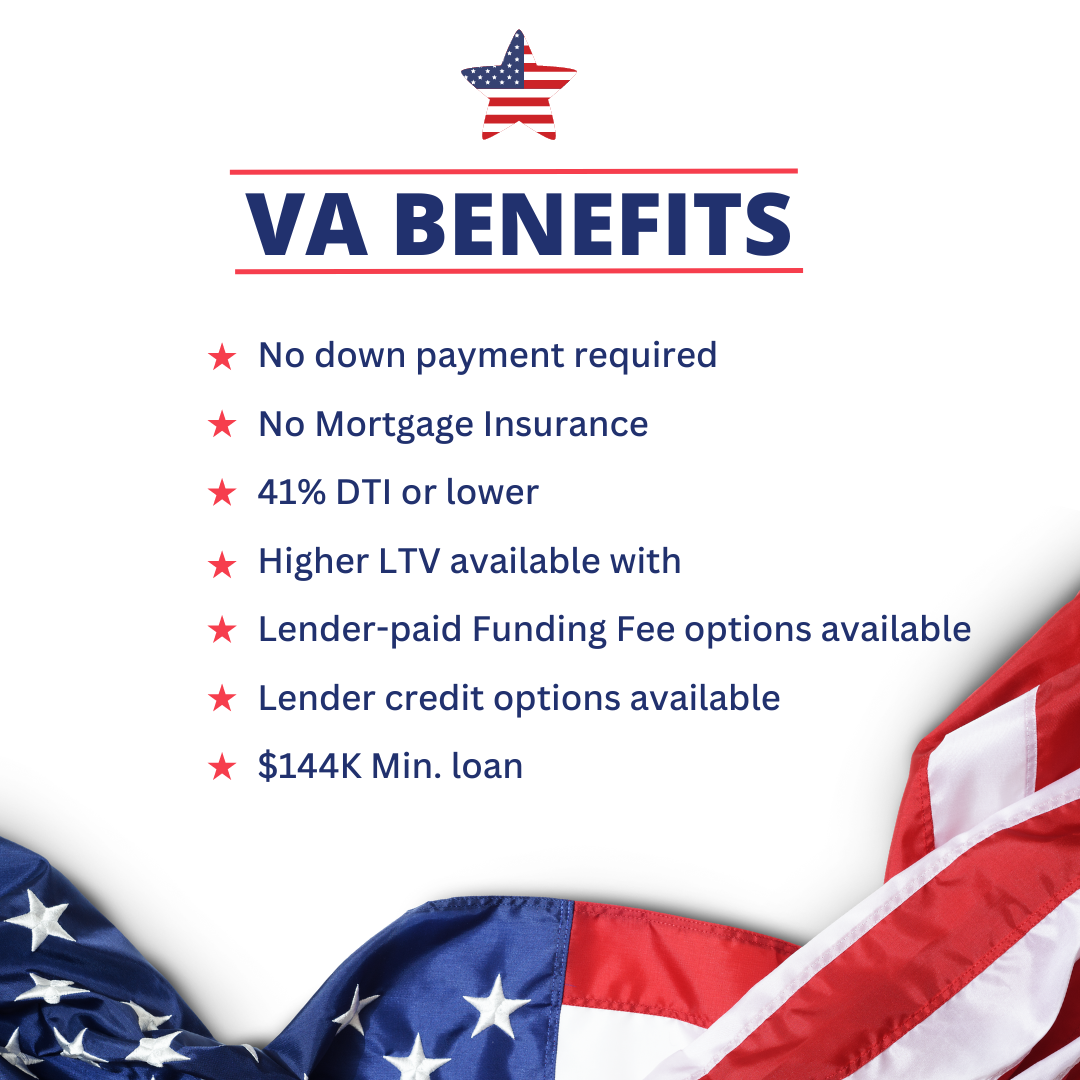

The VA loan guaranty program is a game-changer for veterans aspiring to own a home. We’ll explore how this program eliminates the need for a substantial down payment and helps veterans secure their dream properties, including VA second homes.

Exploring VA Mortgage Refinance: Maximizing Your Home Investment

For veterans with existing VA loans, VA mortgage refinance offers exciting possibilities. We’ll delve into how refinancing can leverage home equity for various financial goals, such as investing in VA second homes or lowering monthly payments.

Veterans Affairs Home Loan: The Gateway to Homeownership

The Veterans Affairs Home Loan program is tailored to veterans’ needs, offering competitive interest rates and eliminating private mortgage insurance. Discover how veterans can make the most of this program when purchasing VA-approved homes.

Introduction:

In the journey to homeownership, veterans have a unique set of tools and opportunities at their disposal. VA mortgage lenders specialize in serving those who have served their country, offering benefits like VA loan guaranty, VA mortgage refinance, and access to VA-approved homes. This comprehensive guide will walk you through the world of VA mortgage lending, helping veterans achieve their homeownership dreams.