Will Mortgage Rates Go Down in 2025? A Realistic Look at What Experts Predict

By a contributing financial observer

After a turbulent few years in the U.S. housing market, one question continues to dominate conversations among homeowners, first-time buyers, and investors alike: Will mortgage rates go down in 2025? With inflation, Federal Reserve moves, and global economic uncertainty shaping the lending landscape, it’s a fair question — but not one with a simple answer.

Where We Stand: Mortgage Rates in 2024

As of late 2024, the average 30-year fixed mortgage rate in the U.S. has hovered around 7%, with some variation across lenders. Chase mortgage rates, for example, have ranged between 6.75% and 7.15% depending on the loan type and borrower’s profile. Similarly, Rocket Mortgage rates have shown fluctuations driven by internal risk modeling and market shifts. Credit union mortgage rates, often favored by long-term members, have remained slightly more competitive but still above historical lows.

This landscape leaves many prospective buyers asking: Will mortgage interest rates go down in 2025?

What the Experts Are Saying About 2025

According to recent forecasts from Fannie Mae and the Mortgage Bankers Association (MBA), we could see a modest decline in mortgage rates in 2025 — but nothing close to the ultra-low rates of 2020–2021.

- Fannie Mae projects that 30-year fixed rates could drop to the mid-6% range by Q3 2025.

- The MBA offers a slightly more optimistic view, expecting rates to reach as low as 6.3% by mid-2025, contingent on inflation trends and Fed policy.

While these projections aren’t set in stone, they reflect a cautious optimism among analysts that the worst of the rate hikes may be behind us.

What Will Drive Mortgage Rates in 2025?

Several factors will influence whether mortgage rates go down in 2025:

- Federal Reserve Policy: If inflation continues to ease, the Fed may begin to reduce its benchmark rate, which tends to pull mortgage rates lower over time.

- Inflation Trends: Persistent inflation could delay rate cuts. Slowing inflation, on the other hand, could allow lenders to offer lower rates with less risk.

- Bond Market Yields: Mortgage rates track closely with the 10-year Treasury yield. Lower yields typically signal declining mortgage rates.

- Global Economic Stability: Geopolitical unrest or recession risks may cause lenders to price in more caution.

Comparing Lender Trends: A Snapshot

While this article is not an endorsement, many prospective borrowers still search for lender-specific insights. Here’s a general look at recent rate behaviors:

- Chase Mortgage Rates: Typically trend close to national averages. Known for stability and digital-first processes.

- Rocket Mortgage Rates: Aggressive marketing and fast pre-approval processes; rates vary more frequently with market shifts.

- Credit Union Mortgage Rates: Often lower for members due to not-for-profit models, though underwriting can be more manual.

Understanding these distinctions can help buyers decide not only when to lock in a rate, but also where to start their search.

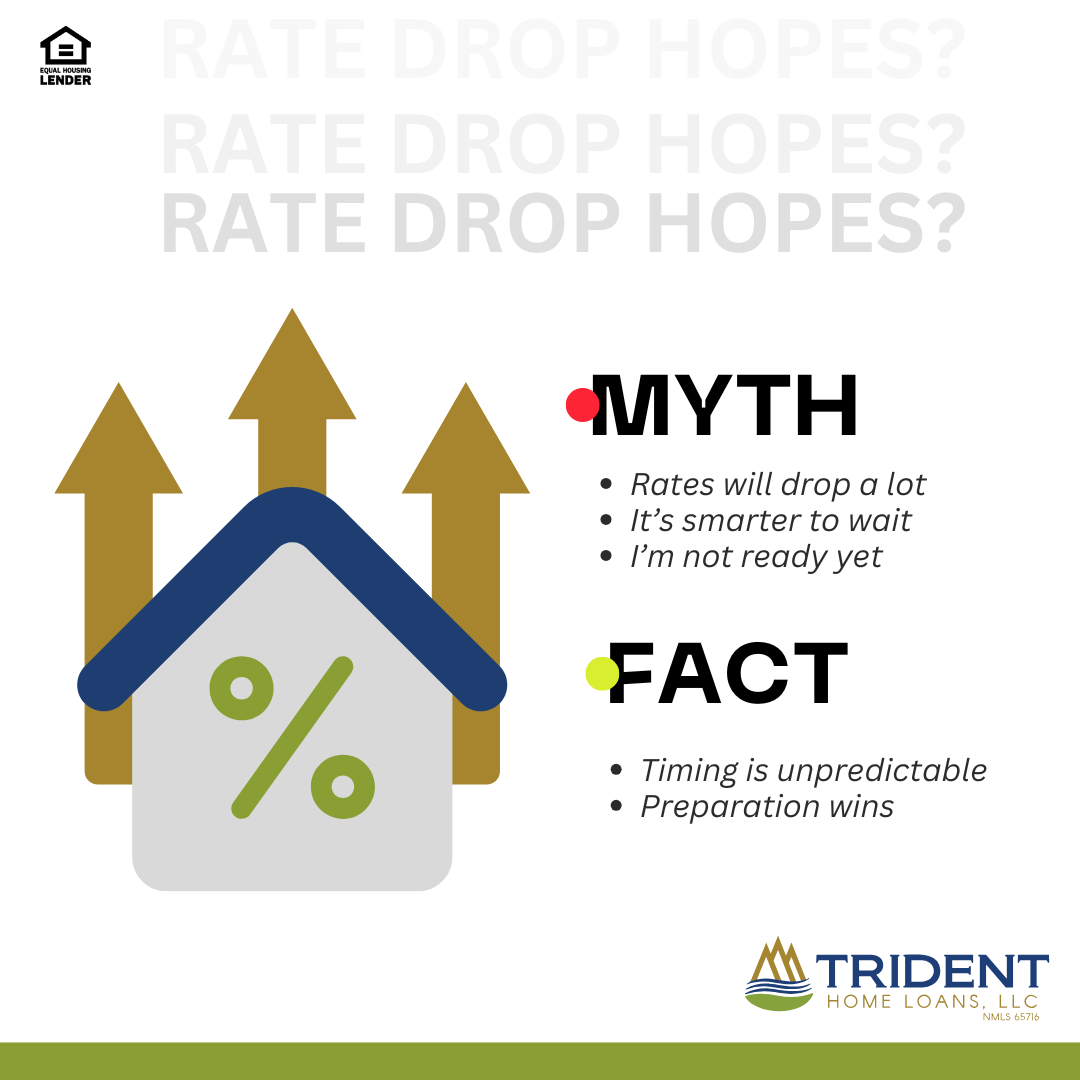

Should You Wait Until 2025 to Buy?

This is the million-dollar question — sometimes literally. While mortgage interest rates may go down in 2025, the housing market itself remains unpredictable. Delaying your purchase in hopes of better rates might mean facing higher home prices or tighter inventory.

Here are some pros and cons of waiting:

Waiting Pros:

- Potentially lower rates

- More time to save for a down payment

- Possible softening of home prices in overheated markets

Waiting Cons:

- Risk of rates staying the same or rising

- Home prices may rebound

- You could miss out on current inventory or investment opportunities

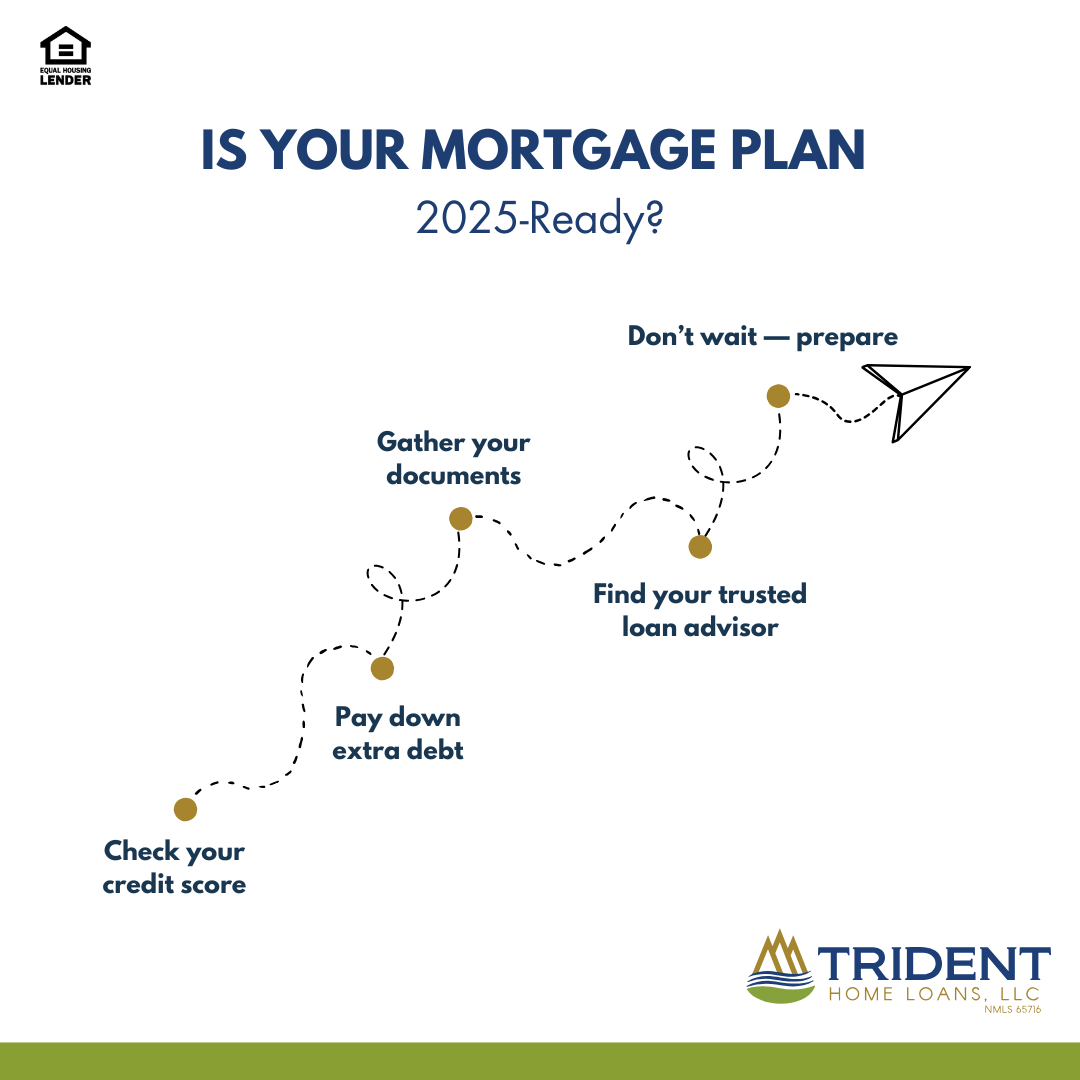

What Can You Do Now?

While predicting rates with certainty is impossible, preparation isn’t.

- Monitor current lender offers, including from Chase, Rocket Mortgage, and local credit unions.

- Check your credit score and improve it where possible — a strong credit profile gives you leverage regardless of market conditions.

- Speak to a mortgage professional to understand your unique position and potential options.

Whether or not rates drop in 2025, the smartest move is to be ready either way.

Final Thoughts

The short answer to “Will mortgage rates go down in 2025?” is: probably, but not dramatically. The market shows signs of stabilization, and while lower rates may be on the horizon, they likely won’t mirror the lows of the early 2020s.

Staying informed, comparing lenders, and acting strategically will be far more important than waiting for a “perfect rate” that may never come.

Want a second opinion on your mortgage plans? The team at Trident Home Loans can offer personalized insights — no strings attached.

Source: Trident Home Loans