How Pilots Can Maximize Their Income for a Mortgage Approval

The Best Strategies to Boost Your Buying Power in 2025

Why Mortgage Lenders Often Get Pilot Income Wrong

Many traditional lenders see pilot pay as “variable” or “unstable” income. But that’s simply not true.

You may have fluctuating flight hours each month, but your hourly rate and minimum guarantee create a predictable income floor. And in many cases, you’re flying more than your base—and getting contractual pay bumps on top of that.

If your lender doesn’t understand these nuances, they may: – Average your income downward – Require unnecessary documentation – Reduce your approved loan amount

Let’s fix that.

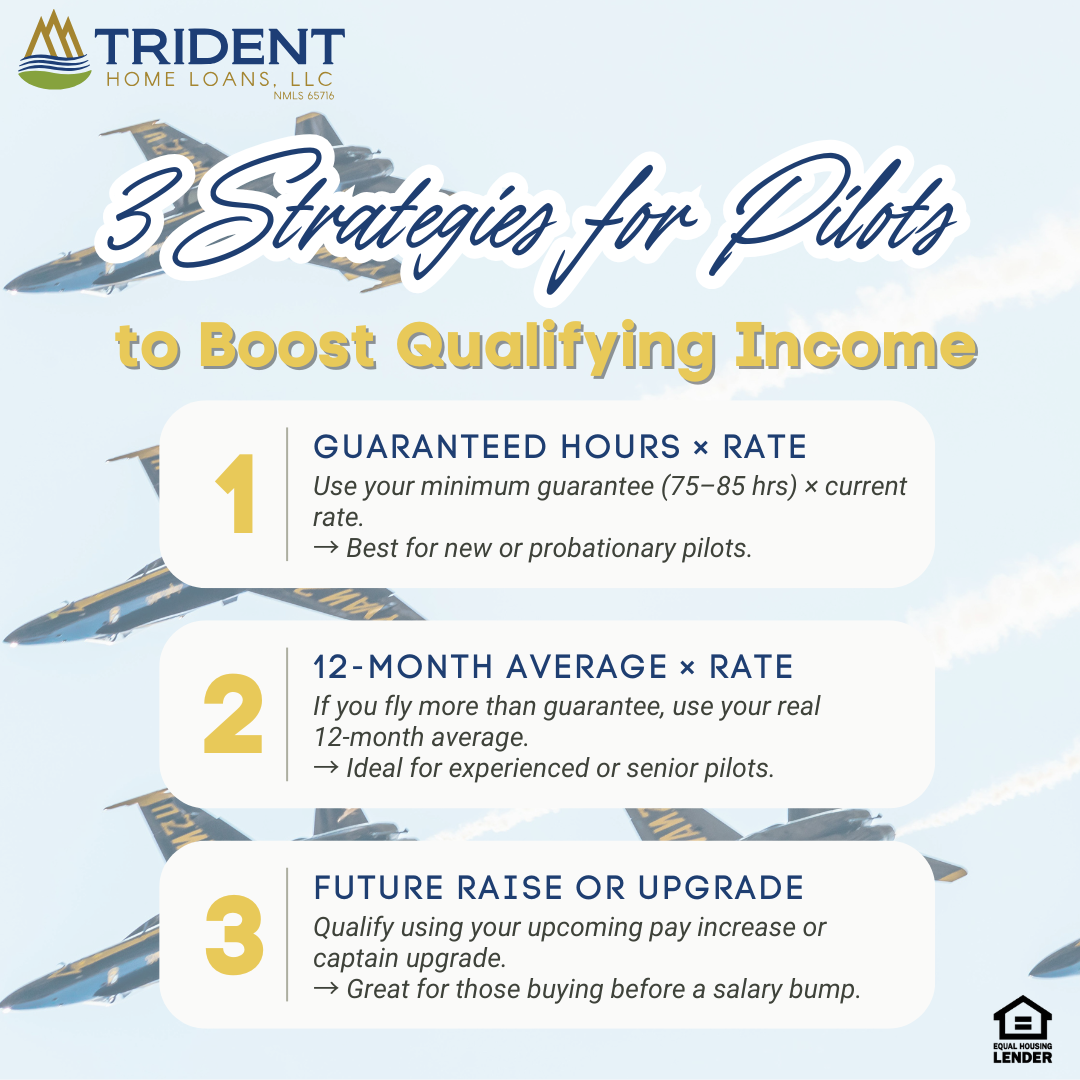

3 Pilot-Proven Strategies to Maximize Your Qualifying Income

At Trident, we use one of three proven methods to get you approved for more house—without working more hours.

1. Guaranteed Hours × Current Hourly Rate

This is the cleanest and most conservative method. We take your minimum monthly guarantee (usually 75–85 hours) and multiply it by your current hourly rate.

Example: FO at $95/hr × 75 hours = $7,125/mo qualifying income.

Best for: – New hires without W-2 history – Pilots on probation – Anyone flying close to guarantee each month

2. Average Hours Over 12 Months × Current Hourly Rate

If you consistently fly more than guarantee (e.g. 85–100+ hours/month), this method lets you qualify using your true income potential.

We average your flight hours over the last 12 months, multiply by your current rate, and use that as your qualifying income.

Example: 88-hour average × $100/hr = $8,800/mo qualifying income → That’s $1,700 more per month than using guarantee.

Best for: – High-hour pilots – Senior FOs or Captains – Anyone flying premium/overtime consistently

Required docs: – 12 months of paystubs or airline portal screenshots – (Optional) Letter from HR or scheduling confirming average hours

3. Future Pay Increases Based on Contract or Upgrade

You don’t need to wait until you start earning more to use that income. We can qualify you based on your future raise or upgrade—as long as your first mortgage payment is after the raise takes effect.

Example: – Your hourly rate increases on November 1 – You close on your house in October – Your first mortgage payment is December 1 Result: We can use the higher November pay to qualify you—even if you’re not earning it yet at closing

This applies to: – Captain upgrades – 2nd year longevity raises – Contractual step increases

Required docs: – Letter from airline or contract showing the effective date and new pay rate

Best for: – Pilots mid-upgrade or getting a known raise soon – Those buying ahead of a known pay bump – Maximizing purchase power without delay

Bonus: Combine Methods to Maximize Every Dollar

In many cases, we model all three income approaches and use the one that qualifies you for the most while still meeting underwriter standards. This is the Trident advantage—we don’t just run numbers; we strategically present your income to get the best possible result.

Why This Matters in Today’s Market

With interest rates falling and airline pay surging, this is a window of opportunity for pilots:

– You’re earning more – The housing market is stabilizing – And smart income strategy lets you buy more with less

But only if your lender understands pilot pay.

At Trident, we close hundreds of loans per year for active-duty, reserve, and commercial pilots. We know the contracts, the pay codes, the schedules—and how to explain it all to underwriters in plain English.

Final Checklist for Pilots Getting Pre-Approved

– Are you flying more than your guarantee?

– Do you have a raise or upgrade coming soon?

– Do you want to maximize your preapproval amount?

– Does your lender truly understand pilot income?

If not—you’re probably leaving money on the table.

Let’s Run the Numbers

Whether you’re upgrading, relocating, or just starting your journey, we’ll help you maximize

your income, simplify the paperwork, and qualify with confidence.

Have questions or want to explore your options?

Email me at [email protected] or call/text 850-377-1114

Visit: tridenthomeloans.com/jonathan-kulak